Best Guess 10x for 2025 Update (2)

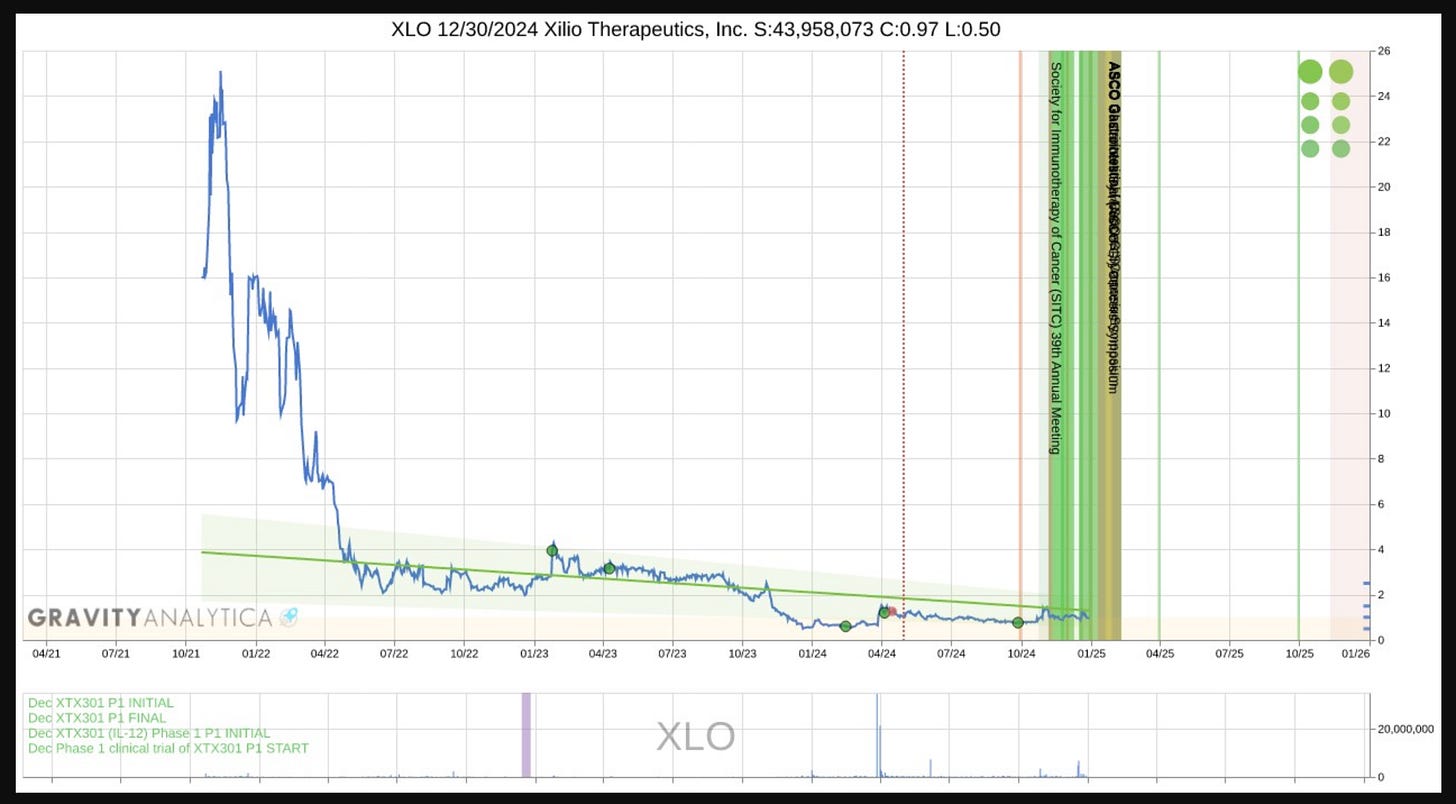

In January, I asked people to guess which stock would make a multiple return.

Nearly 4000 people saw the tweet and 4 posted a guess. I think two were bots.

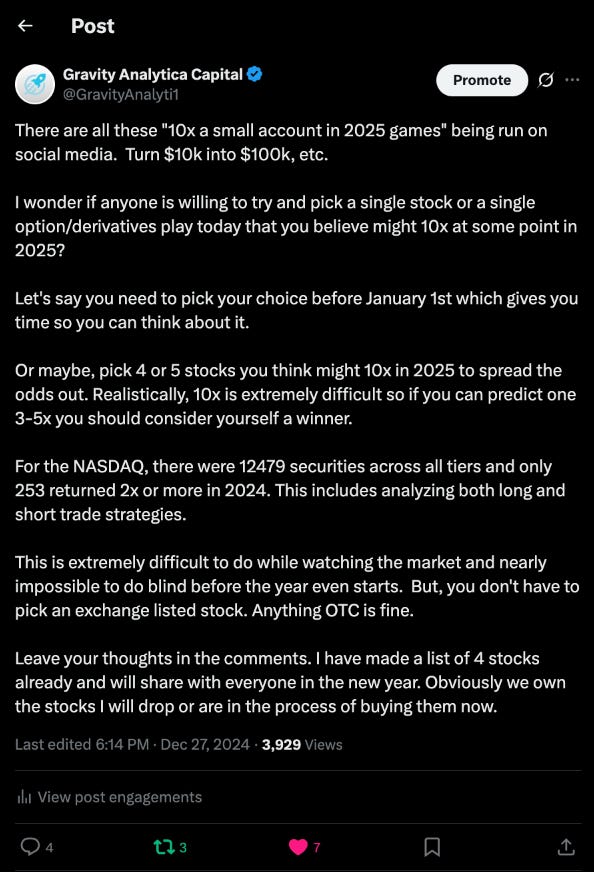

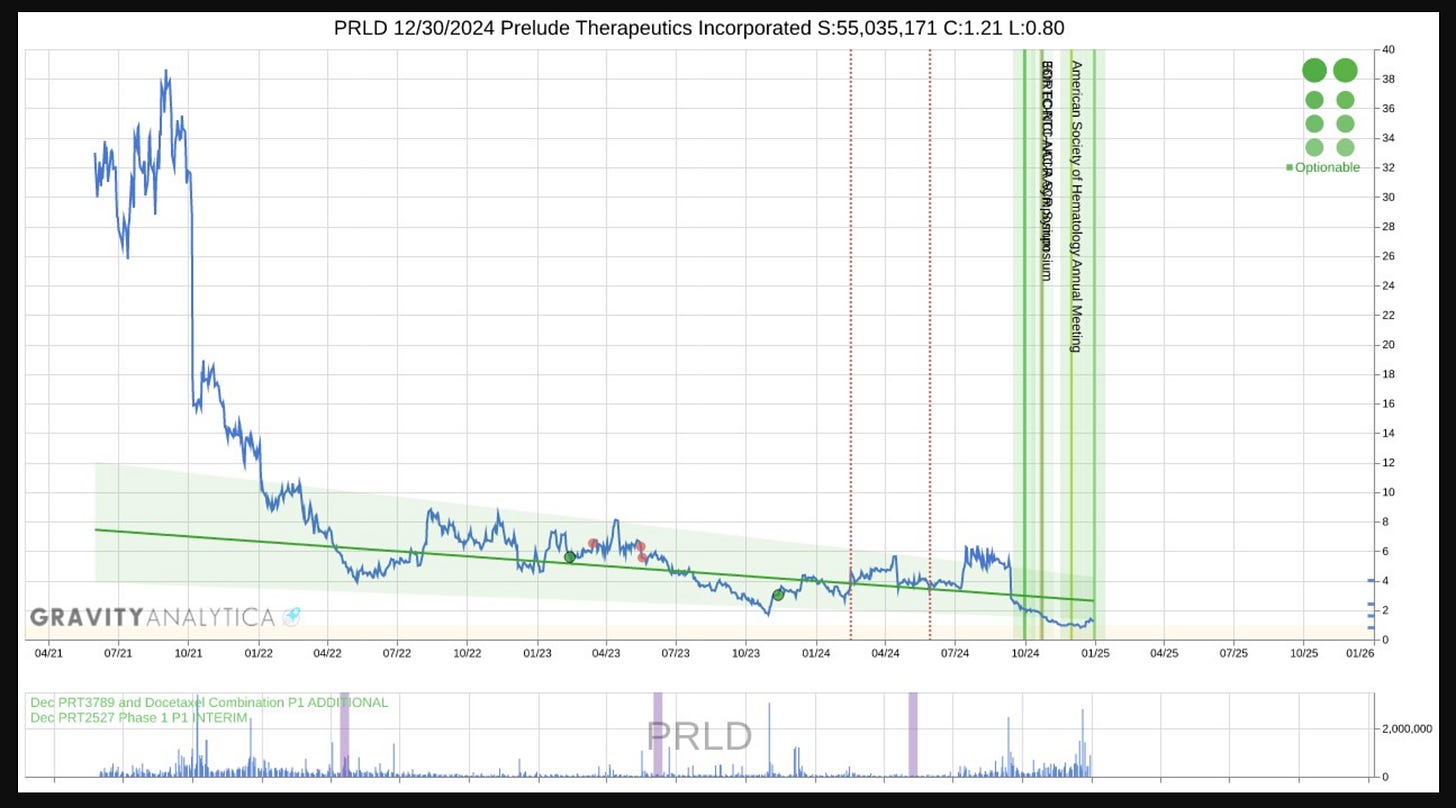

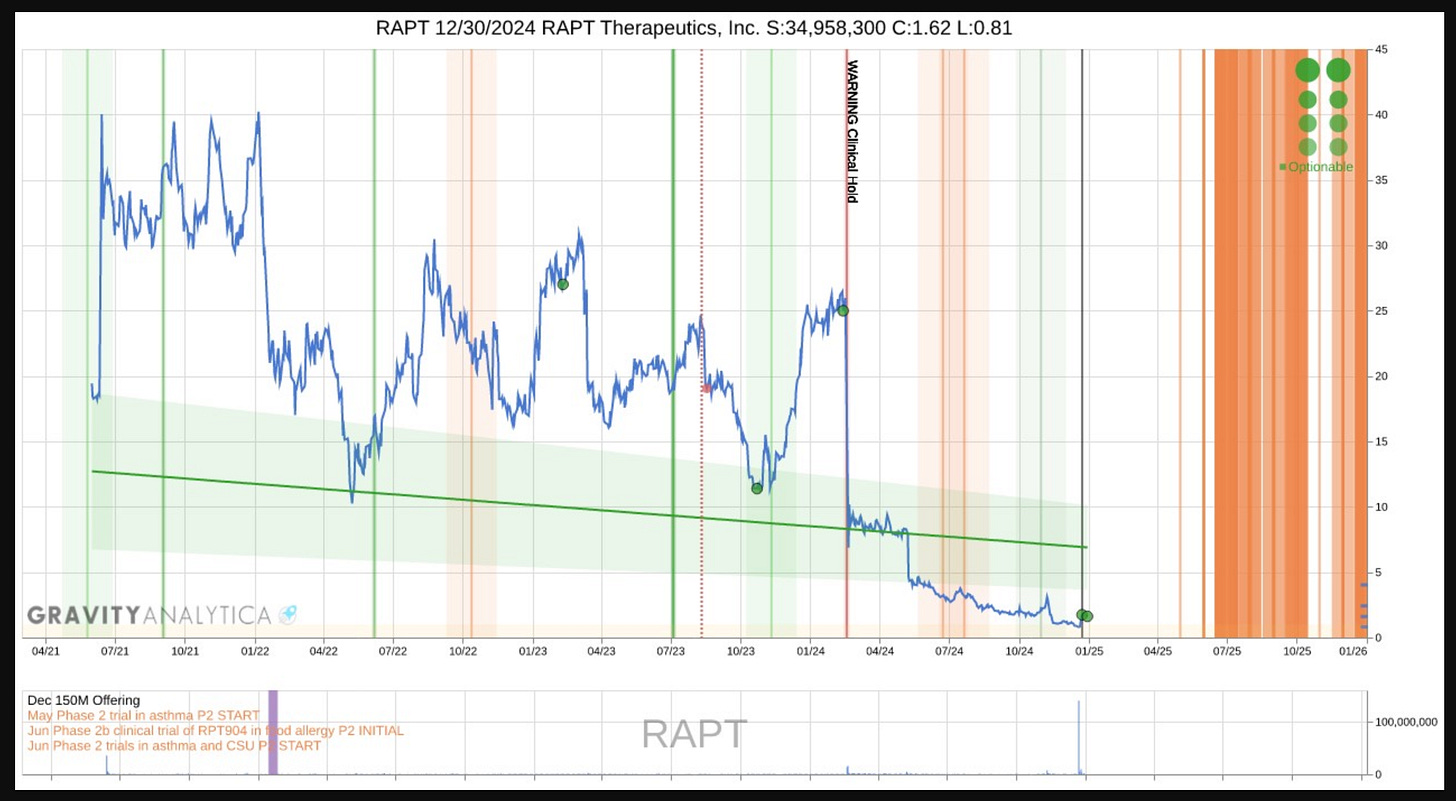

Here are the December 31, 2024 charts for the stocks people guessed on Twitter. You can see from the GA chart you could have avoided these stocks.

Surf Air Mobility returned -28% since January 1, 2025.

BloomZ returned -68%.

NextCure (which we currently own) returned -41% and it’s taking it’s time so far.

And lastly from Twitter suggestions, Prelude Therapeutics which was one of my picks. It returned 9.60% since January 01, 2025. We still own $PRLD.

Here are my others picks. Shattuck Labs, which we still own, returned 87%.

RAPT Therapeutics, which we still own, 104%.

$Xilio Therapeutics, which we still own, returned -19%. But, this stock has had two 100% moves during the time period. We discussed one here in the first update.

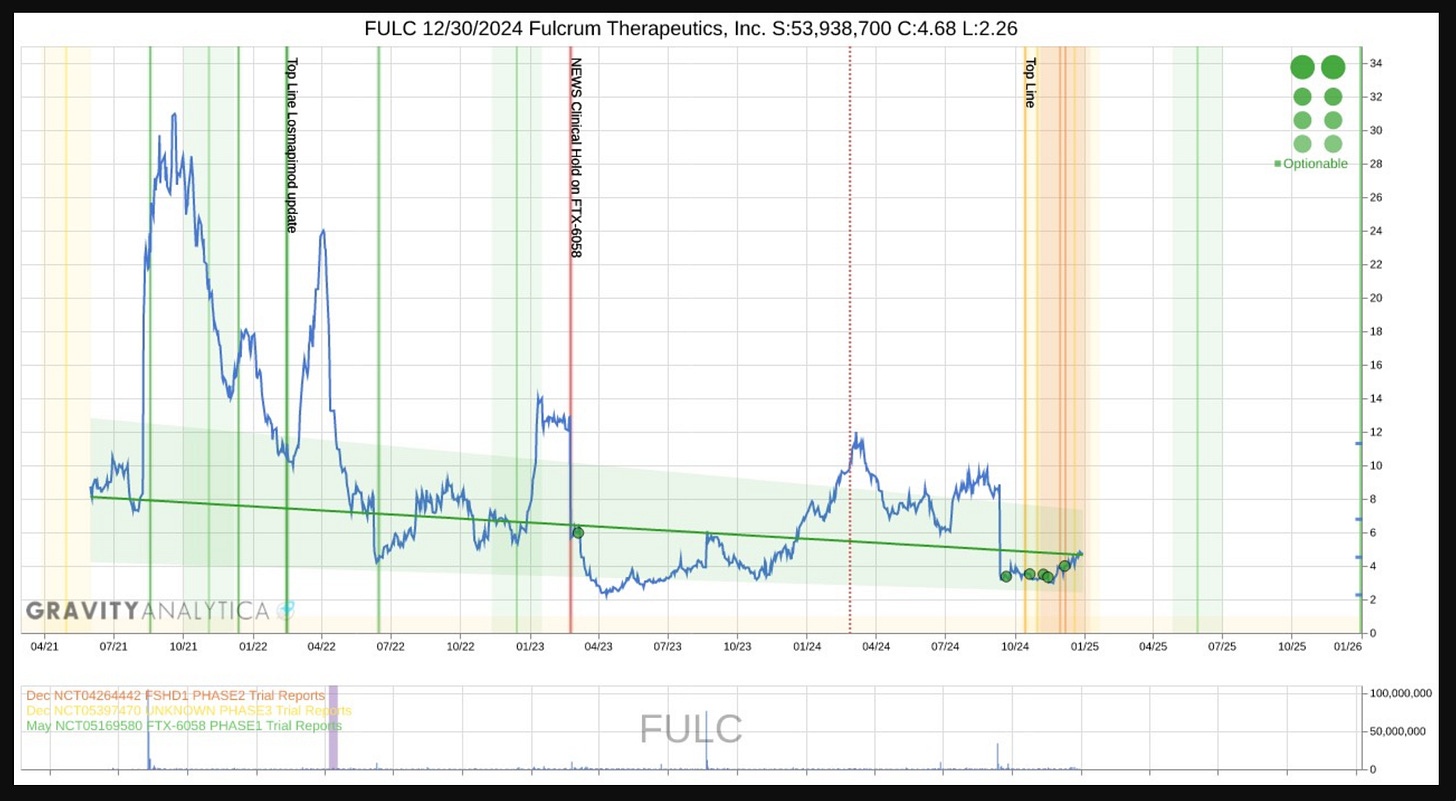

Fulcrum Therapeutics which was the most obvious of the lot returned 79%.

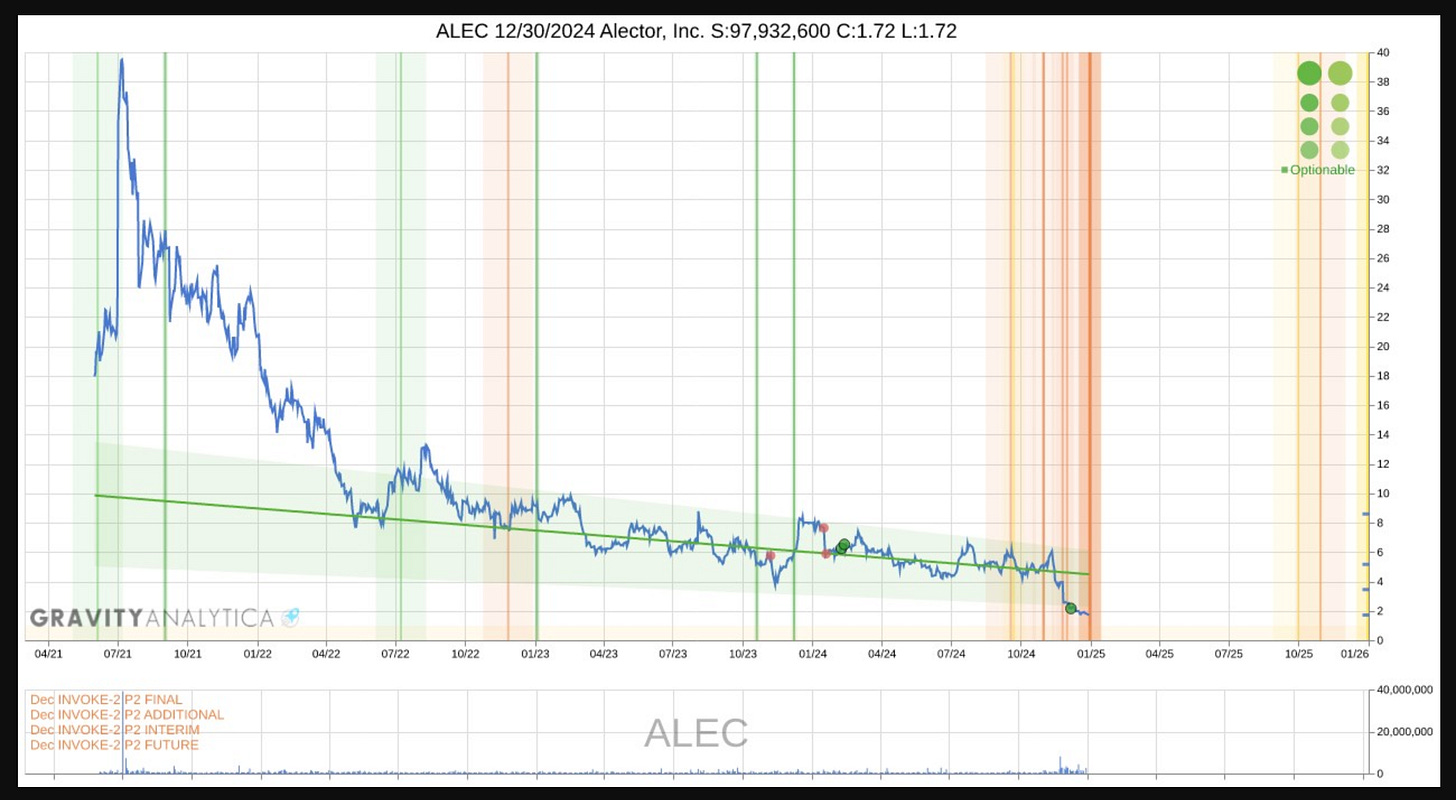

Alector, which we still own and has become a darling of FinTwits of late, returned 61%.

And last Passage Bio, which we still own and I discussed it would need a reverse split first. The return since the reverse split +24%.

So the average return of my picks (so far) is 49% in 9 months which is close to the target of 70% returns per year and this is riding those stocks through the April’s market panic from Trump’s tariff escalation.

As I’ve explained before we run a Zero Intelligence Trader strategy for most of our trading. And I still have no idea what those companies’ drug(s) do or even what the drugs are designed to treat. This is just following liquidity.

But, no 5x return. Yet.

This average return ignores the fact I did flip Xilio twice during the year. The returns are actually higher if you were active but as I wrote in the post Zero to “Fuck You” Money, trading doesn’t need to be a job.

It’s just my job.

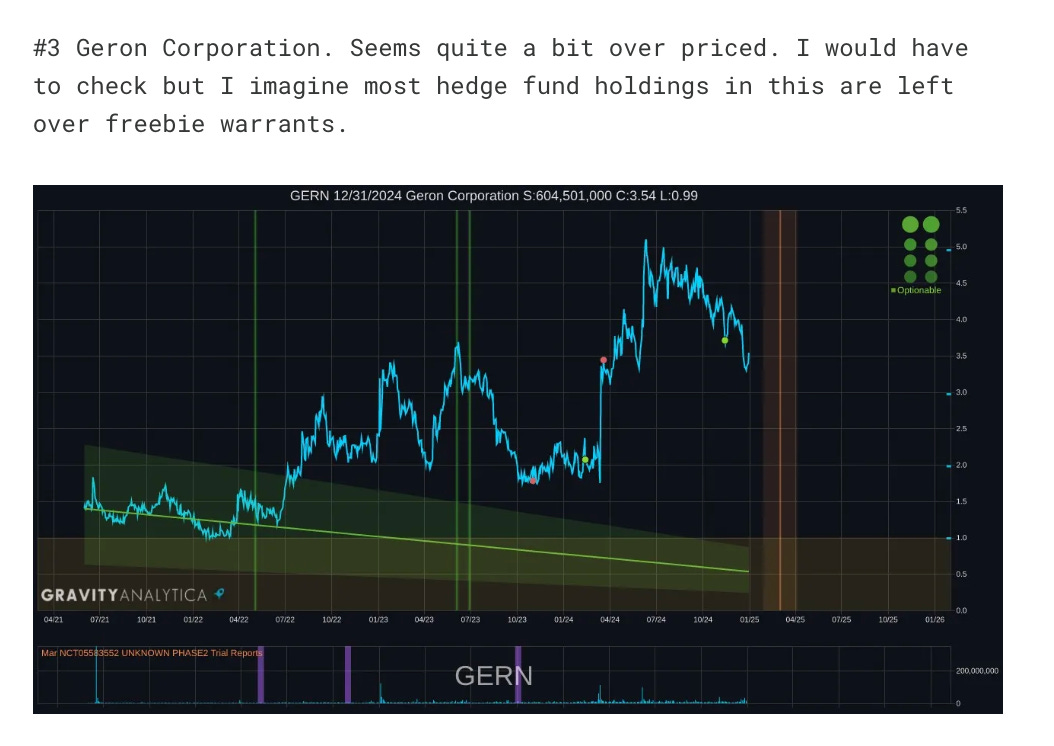

I also wrote about the top 5 hedge fund held stocks in our Top 5 Penny Biotechs (according to HFs). At the time, the list was $NUVB,$RLAY,$GERN,$SLRN and $AMLX.

Here are my notes from January 2025.

Amylyx Pharmaceuticals we recently sold at $14.00. Over 1000% return for us. But, it took over a year.

Those 5 stocks returned 24%,20%, -63%, -50% (approximate because $SLRN did a merger) and +281% which averages to 98% since January 1, 2025. So just one of five did very well and that was enough to make more than 70% this year if you had held those 5 stocks.

If you read the news article on the top 5 held biotechs penny stocks and check the GA charts you’d have done very well by avoiding Geron too.

GI Joe.

As always, if you think there are spelling errors update your dictionary to the latest version. Happy speculation!

— AJ

We can be found on Twitter.

Or in Chat.

Our charts are updated everyday as new data becomes available and are available via subscription. This is because the costs of doing this analysis across 15,000 US-listed securities is not cheap. Compute is not cheap.

Neither is the effort required to find these plays before they move. If you do nothing but read all day, every day, you can beat the market. But we prefer to sleep in and therefor use code.

DISCLAIMER: DO NOT BASE ANY INVESTMENT DECISION UPON ANY MATERIALS FOUND ON THIS WEBSITE. We are not registered as a securities broker-dealer or an investment adviser either with the U.S. Securities and Exchange Commission (the “SEC”) or with any state securities regulatory authority. We are neither licensed nor qualified to provide investment advice. Our website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Past performance is not indicative of future results. The material contained on this page is intended for informational purposes only. GravityAnalytica.com is wholly-owned by Gravity Analytica, LLC. Our website is not an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content of our website and/or newsletter is not provided to any individual with a view toward their individual circumstances. While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained on our website is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between the any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment. We reserve the right to buy or sell shares of any company mentioned on our website or in our newsletter at any time. We encourage you to invest carefully and read investment information available at the websites of the SEC at

http://www.sec.gov

and FINRA at

http://www.finra.org