Bond /bänd/

Stock Market History

I think everyone knows what a bond is but just for the sake of completeness a bond is debt. Here is the explanation I’d gave a third grader or member of Congress.

If you want to borrow $100 you can take out a loan. To make the math simple, let’s say the term of this loan is one year and the interest is 5% per annum (per year if you aren’t an accountant.)

The person or institution loaning you the money is charging you a fee because there is a chance you take the loan and then immediately fall down an elevator shaft. This fee is the interest on the loan. So every month you make a predetermined payment of $105/12 = $8.75 and at the end of the year you have paid off your debt.

Or, you could take out a bond. If you take out a bond you only pay the interest and at the end of the year when the bond matures you owe the full $100 as a lump sum. Now, a person who is prone to open elevator shafts would not be able to take out a bond. The risk would be too high but a company that can survive a few executives disappearing would be able to.

For a bond, you pay (in this example) $5/12 = $0.42 and then return the $100 at the end of the year.

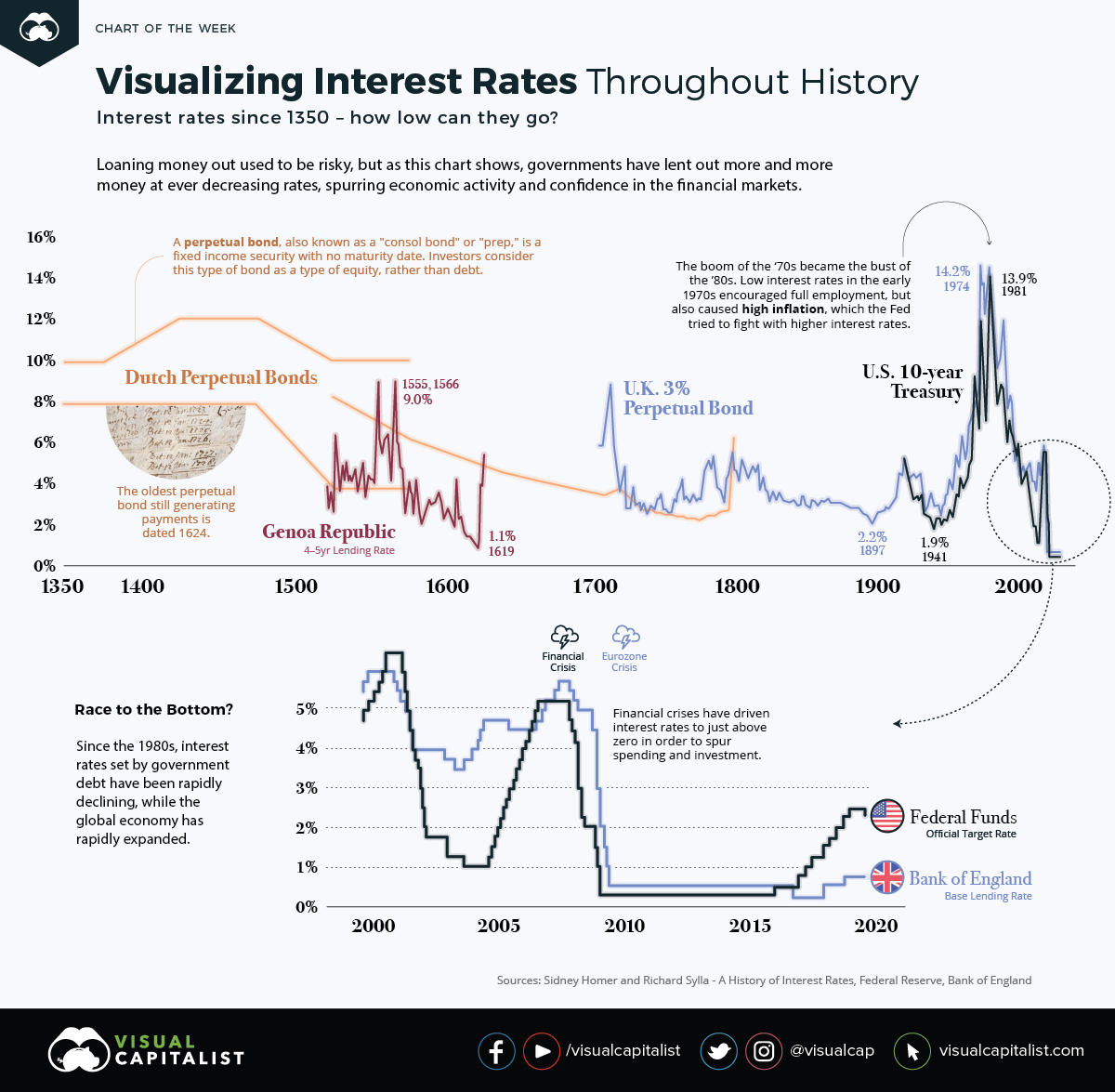

Bonds have been around for a very, very long time. But very few people have ever asked the simplest of questions. Why is 5% yield armageddon and 2% smooth sailing?

In order to answer that question I have chosen to present a very narrow slice of history here and remove a lot of context. There is no way to present a complete picture so I have simplified things.

For this ongoing purpose the only country that exists or has ever existed is Spain.

King Philip the II, ironically as you will see nicknamed The Prudent, ruled Spain from 1556 to 1598. He ruled Portugal from 1580 to 1598. He ruled other places too. For four years he was married to Queen Mary (the ugly one.) Much like Gwyneth Paltrow Philip was a nepobaby. His father had been Emperor and his mother Empress of Portugal. But, unlike Gwyneth, Phillip was not a good business person. Or maybe he was a great person depending on your perspective. But, he certainly didn’t invent the vaginal steamer.

What he did do was invade England. More than once. He also fought the Dutch, the French, the Ottomans, he took over the Philippines. In case you were wondering where the name came from. All of this war mongering and exploration costs a lot of money. And Philip paid for all of this by borrowing money. A lot of it.

He took out bonds from the Genoese in part.

Genoa was a republic located in the armpit of modern day Northern Italy. Much like the modern day US, Genoa failed at production so it became the center of banking in the late middle ages. If that name seems reminiscent of the mob. That’s for good reason. The Genovese Crime family, New York’s oldest mob is named after Vito Genovese. Vito from Genoa. Anyways, back to Spain.

At one point Spain under Philip’s rule was in debt to the tune of 60% of its GDP. Now, that figure is sustainable if you are successful. Modern economies run debt that high but modern states aren’t going to war with England every 20 years and losing.

Winning a war means you get to steal loot. No loot. Bad.

So Spain (and Philip) would lose to England (or whoever) and then default on its debt. A default is when instead of sending a check in payment you sent a thank you, but sorry we aren’t paying you card. This happened thirteen times. Let that sink in for a second.

Technically, Spain only defaulted four times and just said “ut uh” the other 9 times. The distinction is between we can’t pay you and we just aren’t going to pay.

In a period of 42 years, Spain defaulted four times. Which is once every 10 years.

If you were going to loan Spain money how much would you need to charge in interest for that risk? So once every ten year can be thought of as as a 10% chance per year. Now a rational person would just say no after the first default. But, Philip was very much the Trump of his time period and convinced people to keep giving him money. Often the same people he just mailed a thank you card to.

In reality when Spain defaulted or declared bankruptcy, there were still assets held by Spain that could be reclaimed. When Spain defaulted the first time the debt was eventually settled at 60 cents on the dollar.

So the risk maybe 10% but the return in the worst case is 60%. I.e the loss isn’t total. Multiply those numbers together and you get 6%. This is of course over simplified and only meant to give you a narrative not a calculus lesson but you get the gist of it.

Now look at this great history of bond yields and it will make sense why the yields (interest) were what they were. You have to add in the irrational as well. Spain had always been a war with England so this was not a great and scary a thing as World War II for example.

You also have to add in some of the context I removed. Would you rather loan to King Philip at 6% who goes to war every 4 years or to the English who go to war every 8 years? Yields reflect all of this but are rooted in the 15th and 16th century.

People today may not think about why 5% is armageddon but there is a societal memory that goes back to people like King Philip II. So the US30Y hit 5% today. Essentially, the world believes the US under Trump is like Spain when it was borrowing from the mob to lose to England.

As always, if you think there are spelling errors update your dictionary to the latest version. Happy speculation!

— AJ

We can be found on Twitter.

Or in Chat.

Our charts are updated everyday as new data becomes available and are available via subscription. This is because the costs of doing this analysis across 15,000 securities is not cheap. Compute is not cheap. Neither is the effort required to find these plays before they move. But, it can be done by one person, alone. If you do nothing but read. Every day. So why not use our code instead?

DISCLAIMER: DO NOT BASE ANY INVESTMENT DECISION UPON ANY MATERIALS FOUND ON THIS WEBSITE. We are not registered as a securities broker-dealer or an investment adviser either with the U.S. Securities and Exchange Commission (the “SEC”) or with any state securities regulatory authority. We are neither licensed nor qualified to provide investment advice. Our website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Past performance is not indicative of future results. The material contained on this page is intended for informational purposes only. GravityAnalytica.com is wholly-owned by Gravity Analytica, LLC. Our website is not an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content of our website and/or newsletter is not provided to any individual with a view toward their individual circumstances. While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained on our website is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between the any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment. We reserve the right to buy or sell shares of any company mentioned on our website or in our newsletter at any time. We encourage you to invest carefully and read investment information available at the websites of the SEC at

and FINRA at

The company or individuals affiliated may hold positions or may enter into, or exit, positions on any equities at any time. This website and materials found on this website, or in any communication, are meant for individuals of eighteen (18) years of age or older and are not suitable for younger audiences. Materials and information provided on this website and in any communications with or from Gravity Analytica LLC, it's employees or affiliates, are for personal education use by subscribers and may be not be used in any regard in competition with this website or any other product or service offered by Gravity Analytica LLC. Past results do not predict future returns. IF YOU DO NOT AGREE WITH THE TERMS OF THIS DISCLAIMER, PLEASE EXIT THIS SITE IMMEDIATELY. PLEASE BE ADVISED THAT YOUR CONTINUED USE OF THIS SITE OR THE INFORMATION PROVIDED HEREIN SHALL INDICATE YOUR CONSENT AND AGREEMENT TO THESE TERMS.