Correction /kəˈrekSH(ə)n/

People don’t die. They "passed away," "went to a better place," "kicked the bucket" or are residing "six feet under.” These are called euphemisms. A euphemism is any word or expression substituted for one considered to be too harsh or blunt when referring to something we wish to avoid thinking about.

When your dog was run over by a city bus, your parents told you he went to “live on a farm.” This euphemism is as much to save you from suffering as it is used to save your parents from suffering.

You weren’t “fired” you were “downsized.” This euphemism is to prevent you from ripping your bosses head off.

People tend to avoid talking about harsh realities. People go so far to do anything they can to avoid even thinking about unpleasantness.

In Charles McKay’s foundational on the subject of capital calamities, Memoirs of Extraordinary Delusions and the Madness of Crowds (1852), the word correction does not appear once. Crash appears twice.

It’s hard to narrow down where the euphemism correction originated, I have quite a collection of old books on the stock market and I don’t remember the term every being used in the 19th century, but it has been used since the very first mass delusional period of the US stock market.

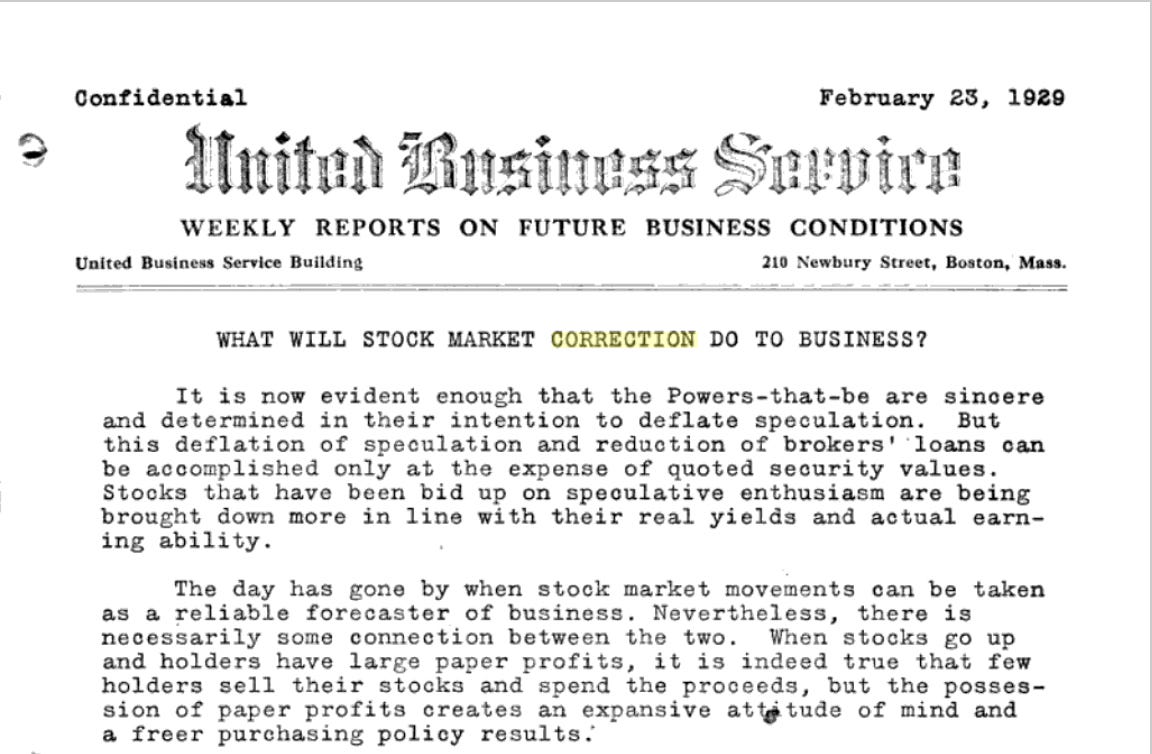

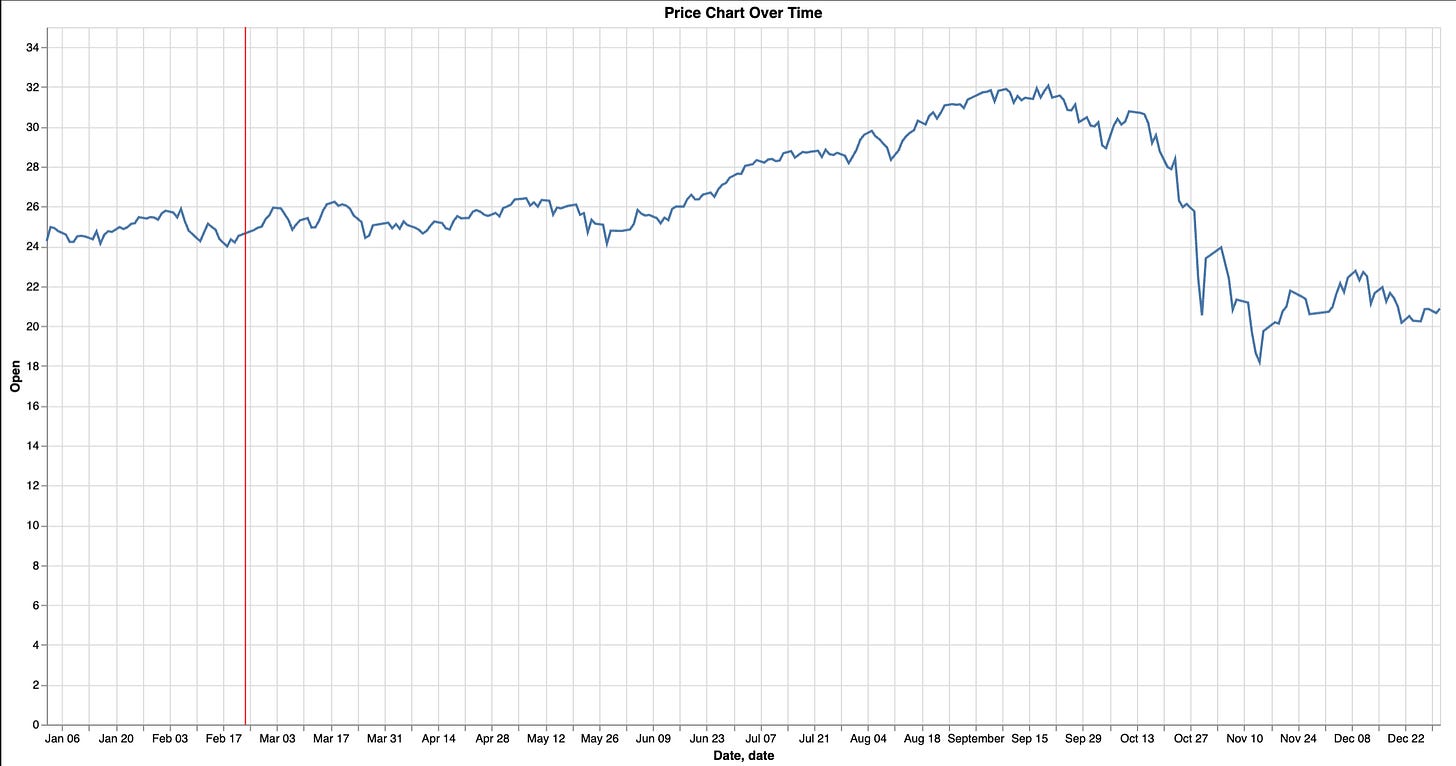

Here is a industry trade from 1929.

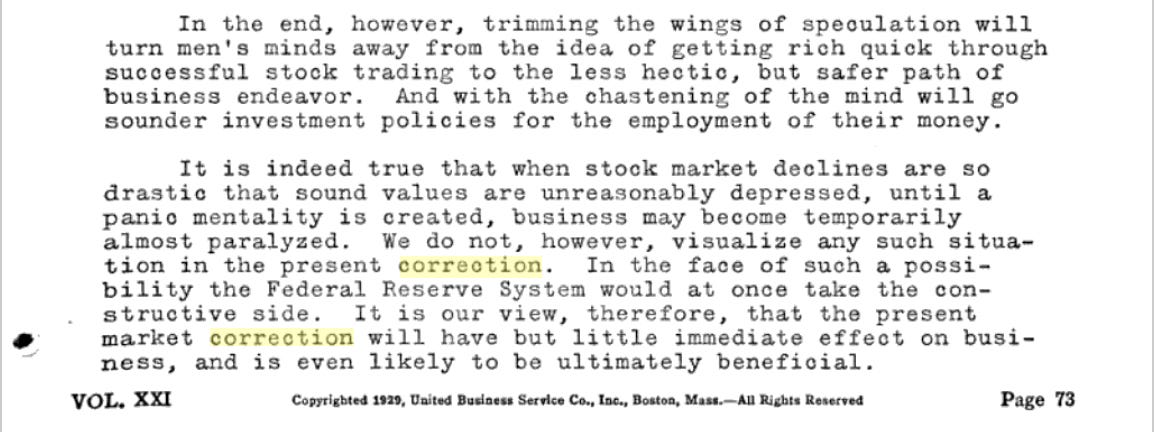

I have marked the date of that bulletin over the stock market chart from 1929. It is apparently obvious that “correction” did not mean a 10% drop at the time.

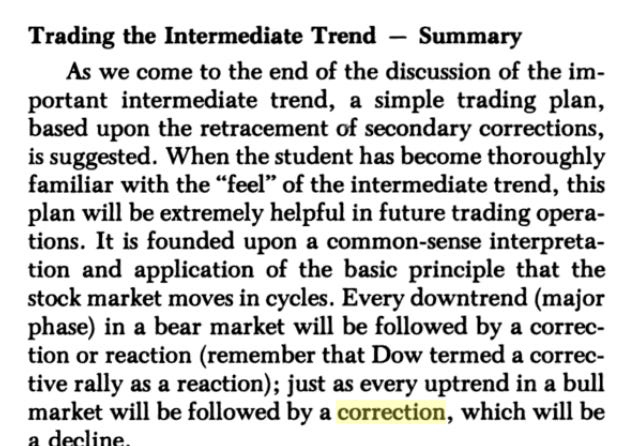

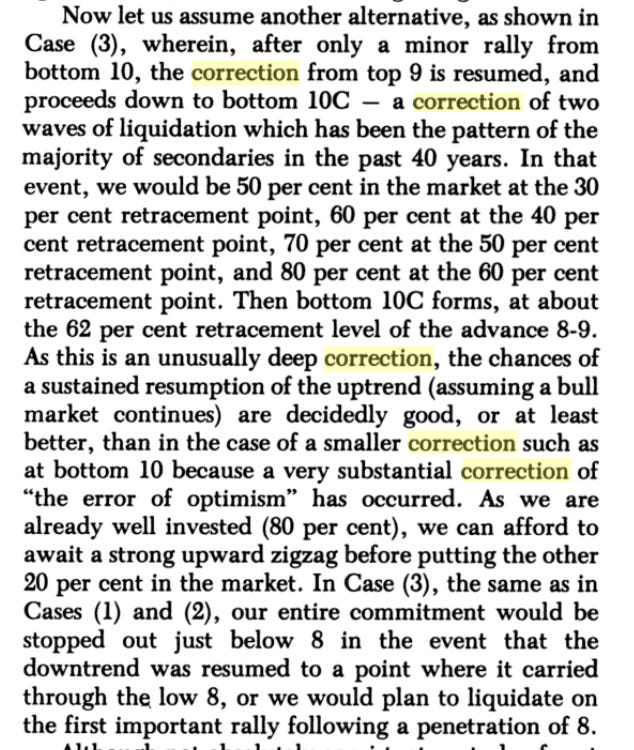

So when did “correction” come to mean correction? Well it appears to have started when people started to draw lines over stock charts. Back to the origination of technical analysis notably to the early practitioners of crayon theory Harold Gartley. Here is excerpt from Gartley’s 1935 book Profits in the Stock Market where the term correction is applied to mean shit is going down. The term at the time was apparently not in common usage as he has to state a correction is a decline.

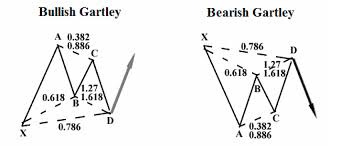

Here are two of Gartley’s patterns. I do find it amusing that there were people in the 1940s talking about “bullish Gartley.” Sounds like a strange sexual practice.

These hypothesized systematic sawtooth patterns, this price origami if you will, are demarcated by primary, secondary, etc corrections. Further word salad.

The rise of technical analysis in the 1980s by the likes of Paul Tudor Jones brought the concept of correction into the modern vernacular of Wall Street. Jones had in his office a print out of the 1928-1930 stock market overlaid with the 1985-1986 market and had triangles scribbled all over it.

At the time, Americans were rabid for news of the stock market which was making them rich. Color television were new to most people. Remember, Bloomberg terminals didn’t exist until 1982. The Cable News Network is just two years older.

If you have never seen an old television the technology was not create at drawing curves so straight lines were in. This trend of bright but straight lines also crossed over into fashion in the form of shoulder pads and lycra.

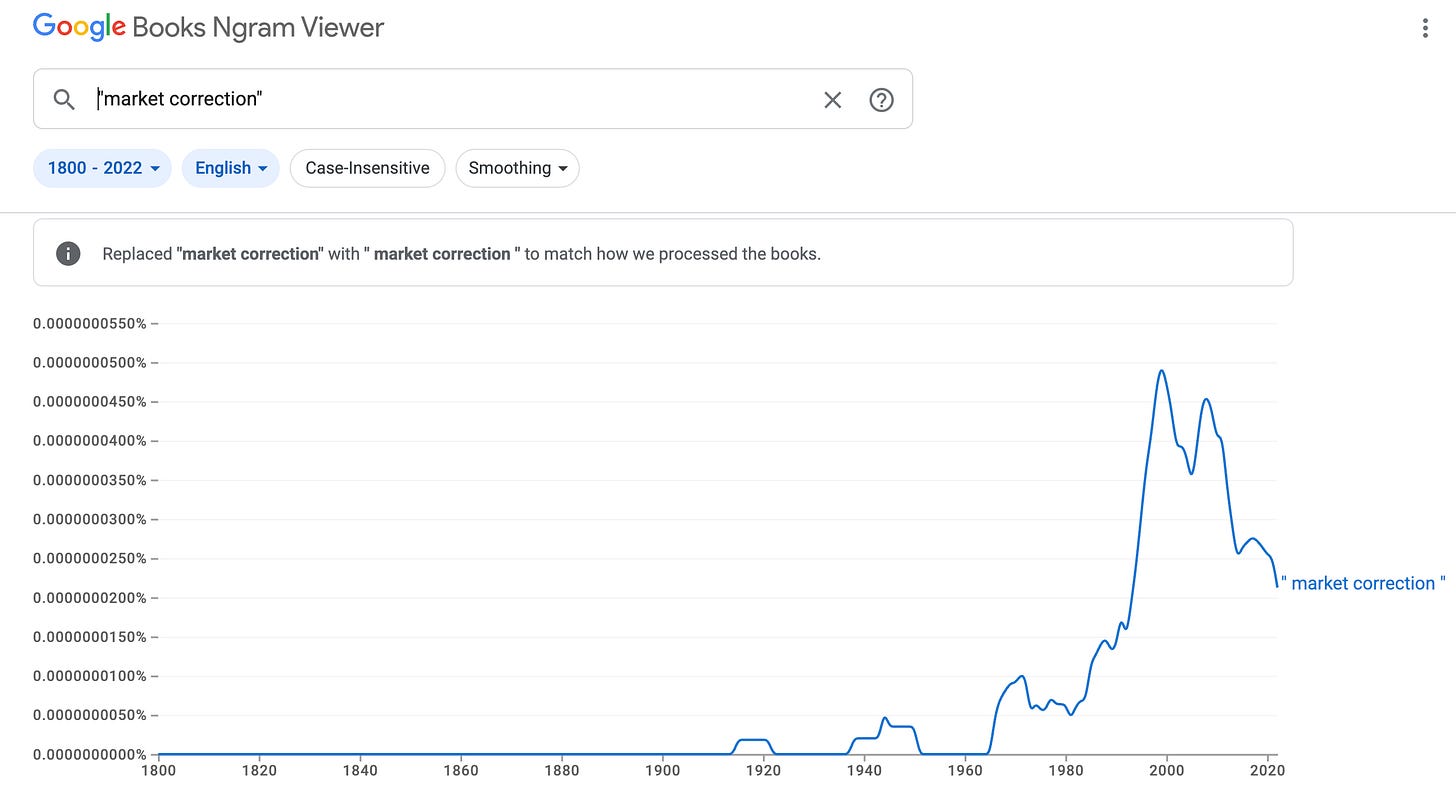

The frequency of “correction”in the literature slowly increased from there. There were corrections all the time! This was just normal. See our sawtooth charts say everything is a-ok. This worked until the market imploded and the euphemism seemed out of place.

It’s hard to say Aunt Emma is in “a better place” if you watched her get sucked into an plane turbine. And it’s hard to say the market was in a correction when people were shooting up brokerages.

Correction gained it’s modern definition of a drawdown of more than 10% but less than 20% at close or 25% intraday sometime in the late 1980s. It’s hard to say which analyst set this value but I am pretty sure they drew lines on charts with crayons.

In case you were wondering what happened to businesses after the “correction” of April 1929. Did it have “little impact?”

No, no it didn’t. It was pretty catastrophic. For example, the price of steel fell 90%.

-AJ