RULE 105 of REGULATION M generally prohibits purchasing securities in follow-on and secondary offerings when the purchaser has effected short sales in the securities within a specified amount of time prior to the pricing of an offering.

To put in plain English, it states you can’t short a stock and then run to the company to get newly issued shares to cover your short position. If you could you could short naked and never have to buy back from the market and/or you could short a stock to depress the stock price, then cover off the market then buy shares from the market at the depressed price. The squeeze the stock.

From March 2017 through May 2019, Sabby Management LLC, a hedge fund, and Hal Mintz the funds manager repeatedly circumvented trading rules to conduct unlawful trades in the stock of at least 10 public companies via the practice of naked short selling. This isn’t my allegation this from the SEC complaint.

SECTION 16(b) of the Securities Exchange Act prevents company insiders from making short-term profits from trading company stock. The Rule applies to company officers, directors, and shareholders who own more than 10% of the company's shares, including fund managers. It is called the short-swing rule.

To put it plaining no insider (from the CEO, a board member or a significant share holder) can sell more than certain number of shares in a given six month period. This rule is why Elon Musk can’t just dump Tesla stock.

Any sales over a certain amount in a six month period are to be regorged (given back) to the company.

Both Rule 105 and the short-swing rule only apply in certain, easy to avoid conditions. For example, Rule 105 provides three exceptions on for “bona fide purchases,” an exception for separate accounts (more on this in a moment,) and an exception for investment companies, and the short-swing rule only applies to insiders.

What constitutes an insider has recently become a point of argument.

In January,

Civil Action 20-cv-02849-CMA-SKC

REVIVE INVESTING LLC v. ARMISTICE CAPITAL MASTER FUND, LTD

was adjudicated by the U.S. District Court for the District of Colorado and it was determined that Armistice Capital was not an insider or more specifically that the Master Fund managed by Armistice Capital was not an insider.

Let’s examine this stock over the period of events it pertains to and see what we can learn and apply that knowledge to existing company states and the purpose of fund actions.

This is going to be an over simplification and will only hit upon certain events in the chain.

What the suit alleged was that on March 10, 2020 Armistice Capital sold its entire position profiting $30MM dollars and that $11MM of that was illegally received.

The stock on that day moved approximately 1000%. The above is cost adjusted to reflect the various reverse splits since 2020 the actual price at the time was below 40 cents. Quite a return if your cost was below $50.00 (cost adjusted.) But was Armistice’s cost that low?

The suit further claims that Armistice started acquiring the company in August of 2017 as a price of $45,000 (cost adjusted.)

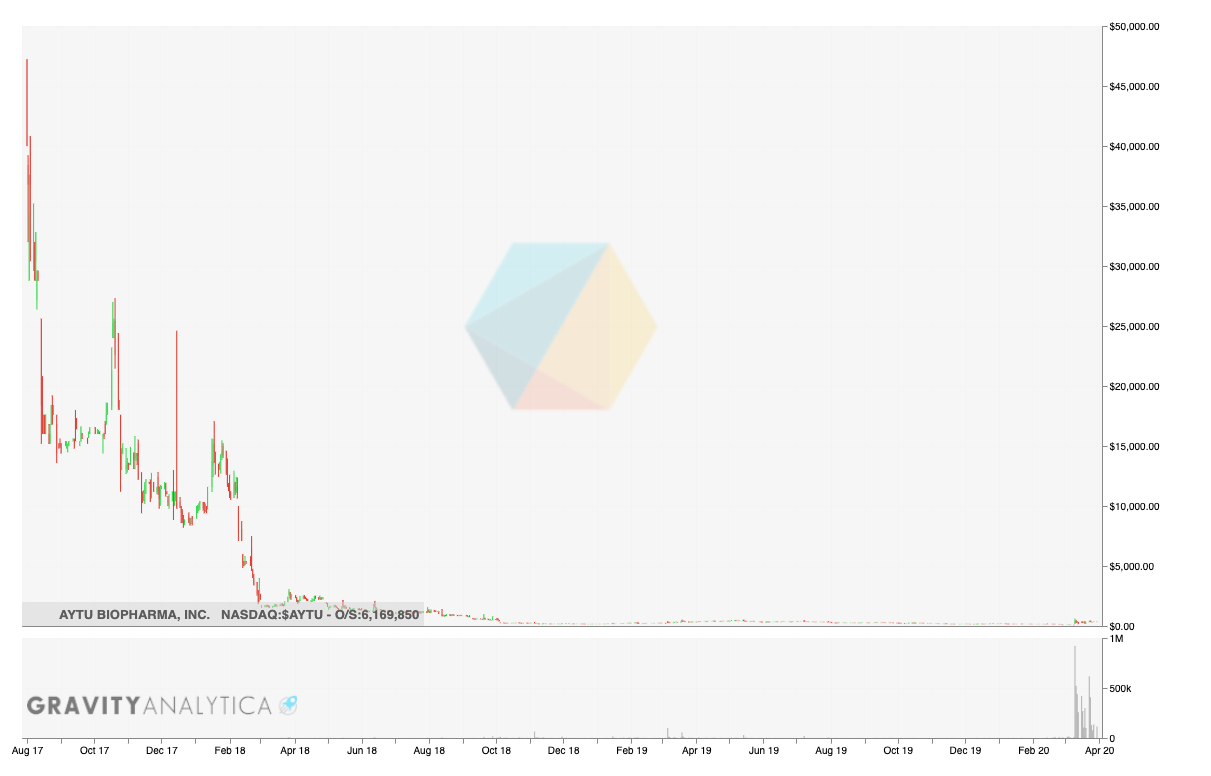

From August 2017 to March 2020 when the alleged short-swing infraction occurred shares of Aytu Biopharma Inc fell just a wee bit. Below is the chart segment spanning the entire period in question. I realize it’s hard to even see the stock price because of the scale required.

You don’t have to be a rocket scientist to understand that buying a stock in August 2017 couldn’t have been very profitable and that no amount of dollar cost averaging or flipping could have reduced this cost enough to make the March 10, 2020 trade profitable.

So the question that comes to mind is how is Armistice Capital still in business if these are the types of investments it makes?

The reason Armistice Capital was found to not be an insider is the Master Fund (a Limited-Liability Company) managed by Armistice Capital but not the same as Armistice Capital was determined not to be an insider even though Stephen Boyd, the manager of Armistice Capital sat on the board of Aytu Biopharma. The provisions set forth here is that as long as there exists a Chinese Wall between the LLCs than one can be an insider and the other can sell shares in a manner that would violate the short-swing rule. So if having separate accounts can prevent you from being an insider what else can you do with separate accounts? Can you have two wives?

This legal separation might be quite useful for what an average retail trader would call evil naked-short selling.

This is going to get messy.Literally there is a lot to fit on the chart here. Bear with the word salad.

Armistice Capital (and Manchester Management) filed the first 13-G (the declaration of institutional ownership) in late August 2017. This report is filed after the transaction and immediately preceded a reverse split. From there Sabby Management, Galileo Partners, Empery Asset Management, Bigger Capital, CVI Investments, Hudson Bay Capital, and Intracoastal Capital all followed suit. Those names probably ring a bell if you are a Gravity Analytica Chat subscriber.

During the entire run the stock continued to fall. Either all of these funds like losing money or they are playing a game beyond buy low/sell high.