Re: 2026

If you have been around for a few years you should be familiar with our speculative strategy which is based on Risk and Liquidity.

Risk: the odds you lose money. Not volatility.

Liquidity: how much capital it takes to move a stock.

We enter on a favorable change in liquidity, i.e. liquidity goes down, via a volume event, institutional purchase, program change such as a probabilistic ∆L or accumulation signature, etc.

And we exit when your positions start to keep you up at night, i.e. when the risk is too high. This could mean relative to another play or related to upcoming catalysts.

Event: something that has happened or will happen.

Catalyst: something that might move the stock.

Not all events move stock. Not all catalysts are foreseeable events.

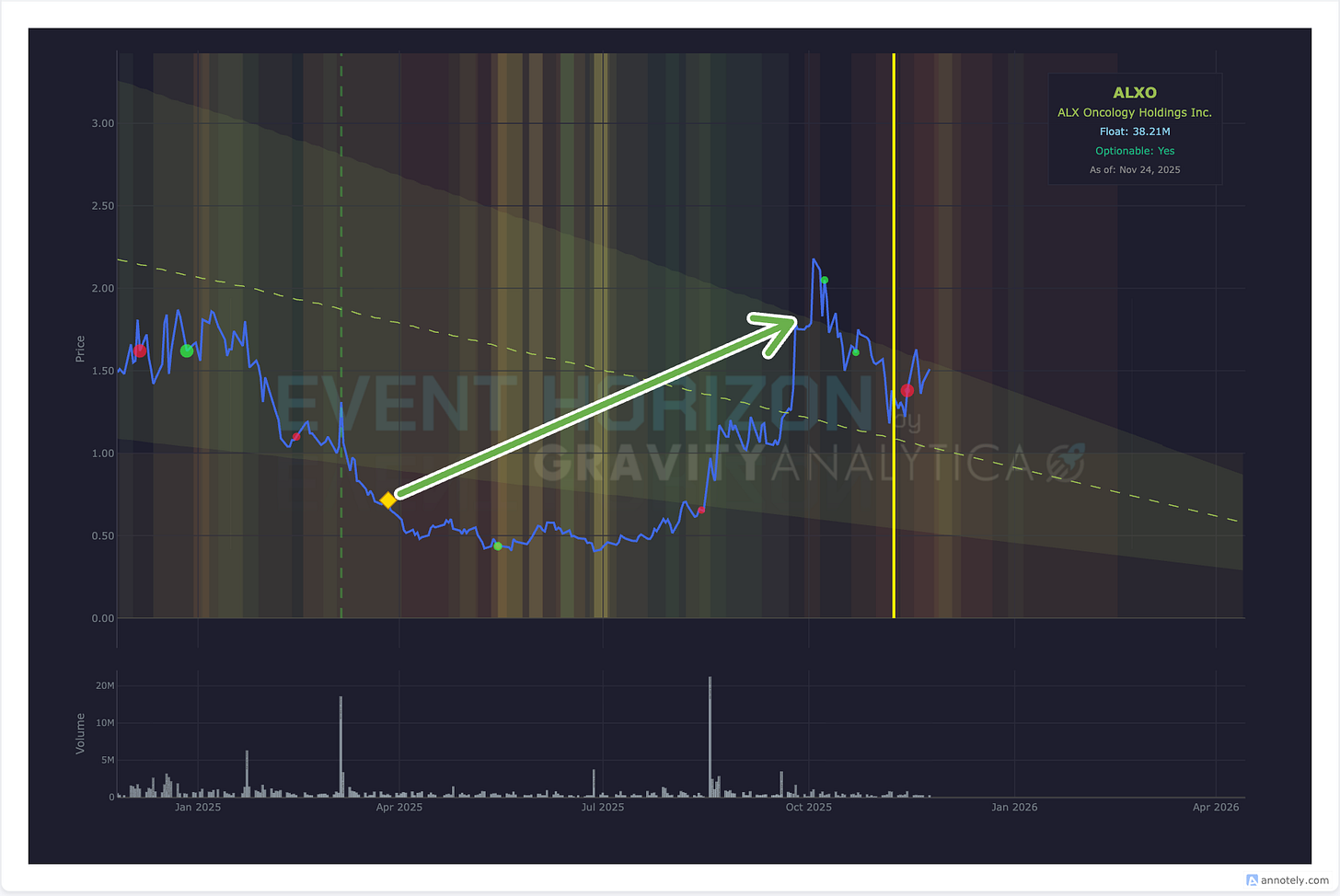

Two recent plays as a reminder.

Unfortunately, right now the market is about risk, liquidity and whatever Trump/Burry are doing on any particular day i.e. volatility.

Not a complete list of current/upcoming concerns but a list anyways:

Japan’s interest rate cycle.

A collapsing job market.

Weakening consumer.

The reappearance of Enron like accounting in the likes of Nvidia and META. For fuck’s sake META.

Trump invades

Iceland,Denmark,Venezuela?Alien attack.

This is a lot to keep track of on top of managing the holdings and I don’t read Japanese.

We typically have been running 95-100% utilization for the last decade in the speculative accounts and that makes opportunistic trading more difficult. I could utilize leverage but that is not something I am going to do (probably won’t do) and getting timely leverage on stocks in the dollar-volume opportunities frequently appear is not often possible.

That means we ride the market while waiting for a stock to run in the speculative account. This normally is stress free - because of statistics - but lately it has become less so and I don’t foresee this changing until Trump is out of office. My hope that he would be less of a moron has been dashed and Scott Bessent I think is a cartoon character at this point.

This past year, especially in the second half of the year, I have been hedging more and more frequently which I hate doing. When I don’t trust the market enough I am willing to waste capital as protection against some Tweet that is a bad for my stress levels.

Now, do I think there is an immediate problem?

Not really.

I think interest rates are going to fall, not as slowly as the market wishes but fall. I don’t see resurgent inflation at this point. Trump seems to at least have figured out that tariffs cause inflation and is backing away.

Do I think there is a serious problem underneath the surface. Yep. The US financial system (markets including) is a building being built ever higher and higher on top of a sinkhole. A sinkhole we keep filling with money. But, since Trump wants to print money and is finding new creative ways to do that (like requiring stable coin issuers to buy Treasuries since foreign purchasing as slowed) we should be fine for at least six-ish weeks.

Do I think modern market participants are cats on amphetamines, yep. This past month Burry just pointed out what has been patently obvious for over a year and meow they all fucking jumped into the window treatments and hung themselves like idiots.

Especially, the new-to-the-market foreign “traders.” The highly leveraged gamblers out of East and South East Asia are hard to plan around.

Volatility is fine. If you are floating hedges. But, it gets expensive to float hedges when the VIX is over 15. Or if you have cash just lying around and don’t have move out of a trade and into a Put/Call option in a hurry.

This Christmas season is going to get hit by tariffs as well. Will consumers spend more over-and-above to compensate for this added cost?

I don’t think so.

The numbers will likely be a record in terms of dollars spent but I don’t think that is going to translate into higher profits.

Share repurchases are still ongoing though. They should start to wain especially in the cap-ex strapped digital-girl-friend AI space if they haven’t already. And this music is hard to hear even if you are straining to listen unless you work inside a market maker.

So as I discussed briefly in August, going into 2026 there will be a strategy change!

I will be splitting the speculative holdings account across two accounts. There are a few reasons for this. First, I want to lower exposure over all. Second, I expect something to break in 2026 and I want to be able to capitalize on the volatility. Third, this account is now at a size where I can no longer keep track of everything in it.

That itty bitty little blip so far has netted me 69%. Just because we knew about the trade as it setup and were able to buy it right as the news broke. Still holding this. Hoping for $1.00.

In one account I will focussing less on “playing the odds” and more on targeted plays.

Not, just choosing a sampling of stocks in every state and waiting. Stock picking.

In the other, I will sit in cash and just wait out the right opportunities as they present themselves and let the market do whatever it wants without me worrying about it. This means if the right trade is to day-trade, that is the trade I will make.

The primary goal is still the same 70+% returns. If the market stay status quo that should be easily achievable using only half the capital. And, I am actually for once going to try and beat that return since I have so much capital now. I’ve never tried to make more than 70%.

I’ve also just added a new secondary goal this year.

Relax more.

There is also a psychological benefit to running the speculative accounts like this. I run three accounts personally and when one is down I can just close it and look at the others. So when the market is throwing tantrums that some Fed governor said two instead of three rate cuts I can just only look at the account holding cash and not be stressed.

This is the dump-the-kids-at-grandmas approach to account management.

There are a lot of people subscribers so I will write up a series of refreshers both on the tools we use as well as to discuss some new concepts we haven’t had to worry about in recent years.

Like credit default swaps and the hooker index.

— AJ