Short Idea #1 Oct 2, 2025

Blarcamesine is an oral small molecule that targets the Sigma-1 receptor (SIGMAR1) evaluated in two trials.

Phase IIb/III (ANAVEX2-73-AD-004)

Design: randomized, double-blind, placebo-controlled, ~48 weeks, ~508 participants with early AD / mild cognitive impairment.

Co-primary endpoints: ADAS-Cog13 (cognition) and ADCS-ADL (function).

Secondary endpoint: CDR-SB (Clinical Dementia Rating – Sum of Boxes)

ADCS-ADL stands for Alzheimer’s Disease Cooperative Study – Activities of Daily Living scale and is a questionnaire-based measure completed by a caregiver or study partner.

ADAS-Cog13 is the 13-item Alzheimer’s Disease Assessment Scale – Cognitive Subscale administered by a trained clinician.

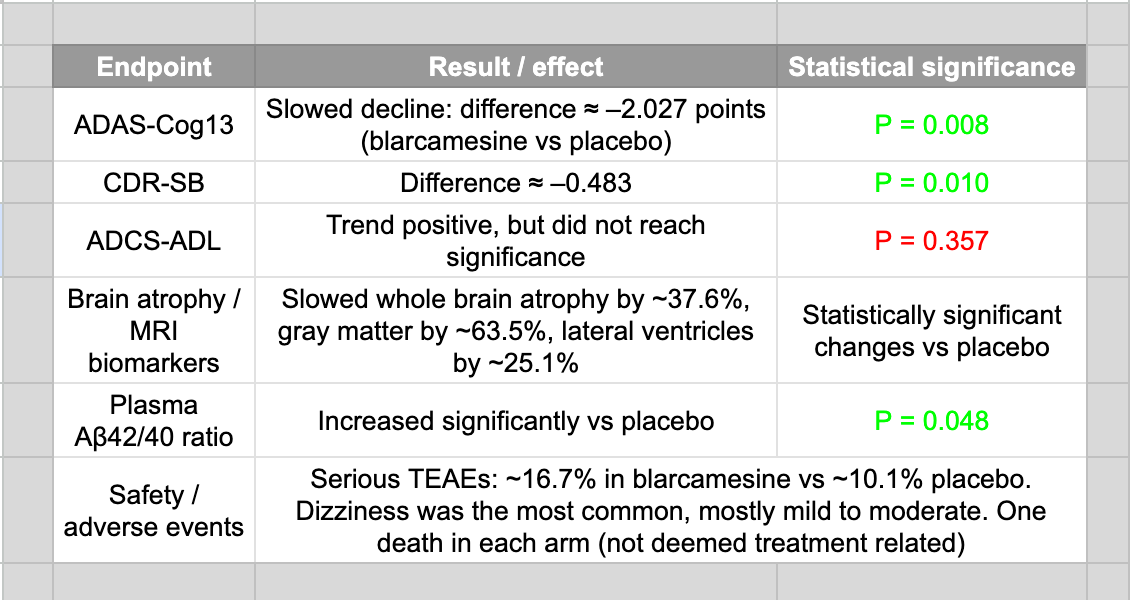

Results at 48 weeks.

Long-Term / Extension (ATTENTION-AD open-label) follow-up.

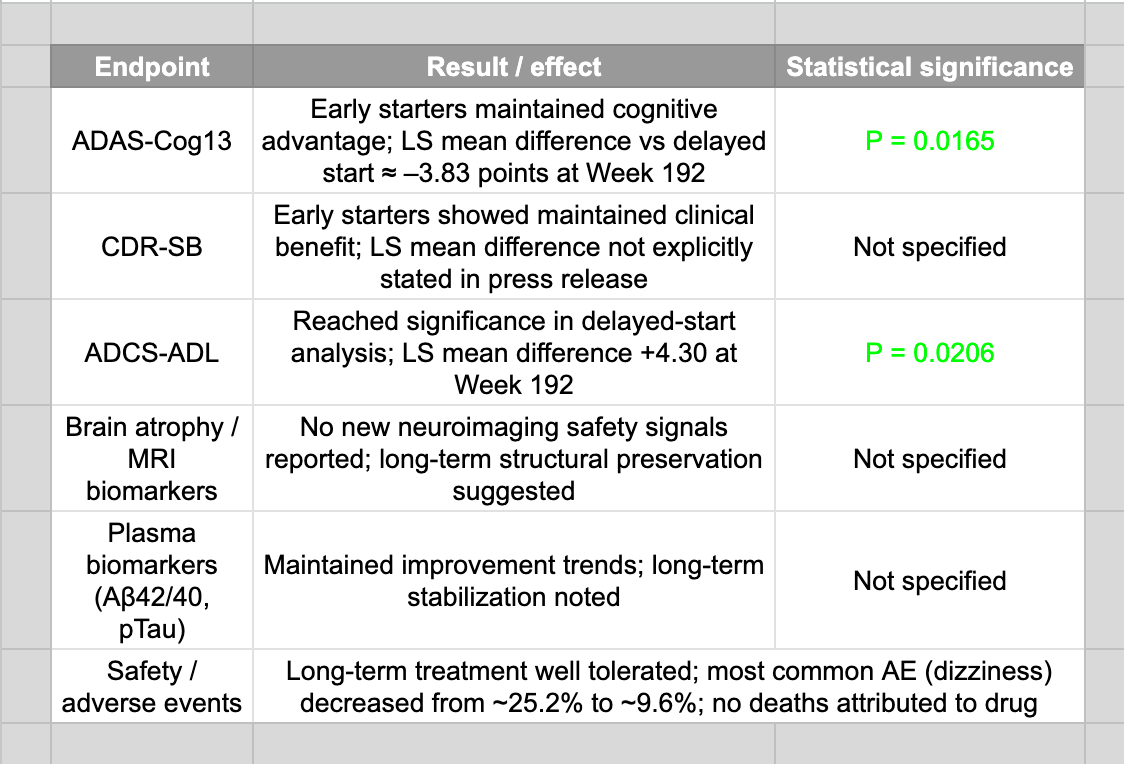

Results at 192 weeks (four years) published in The Journal of Prevention of Alzheimer’s Disease (impact factor of 7.8.)

From the company’s regulatory filings,

“In November 2024, [the company] announced the submission of a Marketing Authorisation Application (MAA) to the European Medicines Agency (EMA) for ANAVEX®2-73 for the treatment of Alzheimer’s disease and, in December 2024, the EMA accepted the submission for scientific review. The MAA, if approved, would allow direct market access throughout the European Union for oral ANAVEX®2-73 (blarcamesine) for the treatment of Alzheimer’s disease.”Based on the European Medicines Agency’s (EMA) standard procedures for evaluating a Marketing Authorization Application (MAA), the review process typically takes up to 210 active days, excluding any clock stops for additional information requests.

Given the standard review timeline, a decision from the EMA is expected around November 2025. It is unlikely this received a priority review.

Anavex’s pipeline is almost entirely centered on blarcamesine (Alzheimer’s, Rett syndrome, Parkinson’s dementia), if the EMA were to issue a negative opinion, or asks for more data (clock stops, withdrawal, resubmission), this would be disastrous for the share price since it is trading at such a premium.

Also behind the hood so to speak, during the last price spike the company filed a 424 to sell,

“Up to $150,000,000 of Common Stock” via “at the market” Sales Agreement with TD Securities.There are also

"10,000 shares of common stock issuable upon the exercise of outstanding warrants with a weighted-average exercise price of $12.00 per share” pre-existing from 2023. It is likely just coincident the stock crossed $12.00 recently.

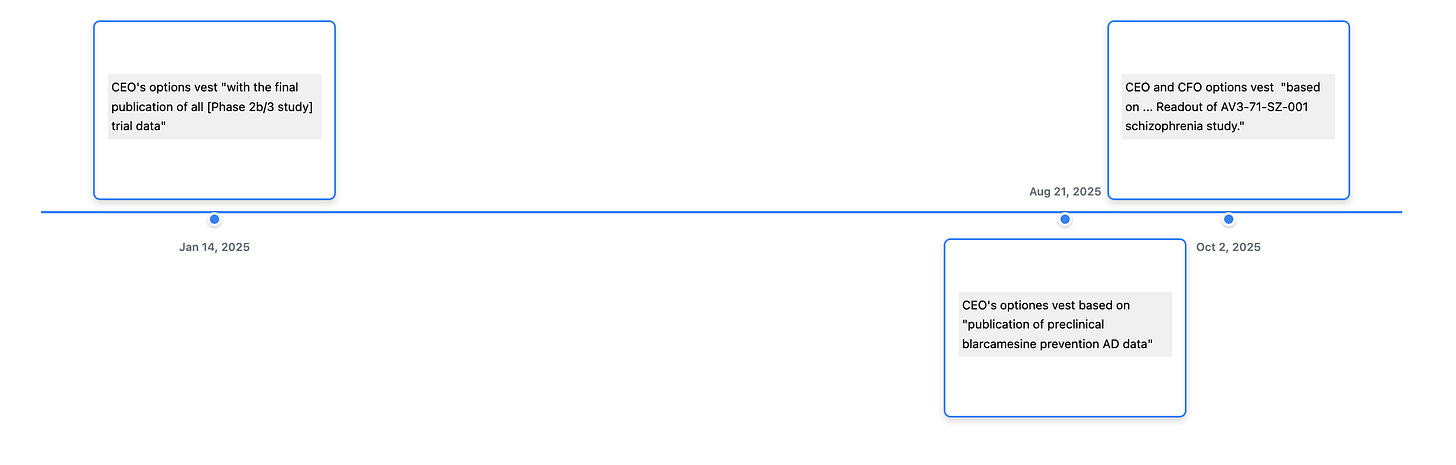

And the CEO’s (and other executives) incentive plan is tied to achieving various milestones which is not unusual but it does provide an incentive to delay regulatory submission if the expectation is for a rejection. The original Phase IIb/III (ANAVEX2-73-AD-004) trial results were reported in December of 2022.

You can find this information in the Form 4’s “Explanation of Responses.” I have provided examples in the time-line below.

Beyond that when I look at the institutional profile all I see is retail. There is not a whole lot not to like here. There is likely to be investment banking support but only to a point. Once the Committee for Medicinal Products for Human Use (CHMP) decision is announced this stock likely will fall precipitously.

We have no position.

As I’ve said before we rarely short anything and don’t short biotechs. I wrote this because I was asked about it earlier and mostly because I wanted to show off my new time-line tool. So if you made it this far check it out here.

As always, if you think there are spelling errors update your dictionary to the latest version. Happy speculation!

— AJ

We can be found on Twitter.

Or in Chat.

Our charts are updated everyday as new data becomes available and are available via subscription. This is because the costs of doing this analysis across 15,000 US-listed securities is not cheap. Compute is not cheap.

Neither is the effort required to find these plays before they move. If you do nothing but read all day, every day, you can beat the market. But we prefer to sleep in and therefor use code.