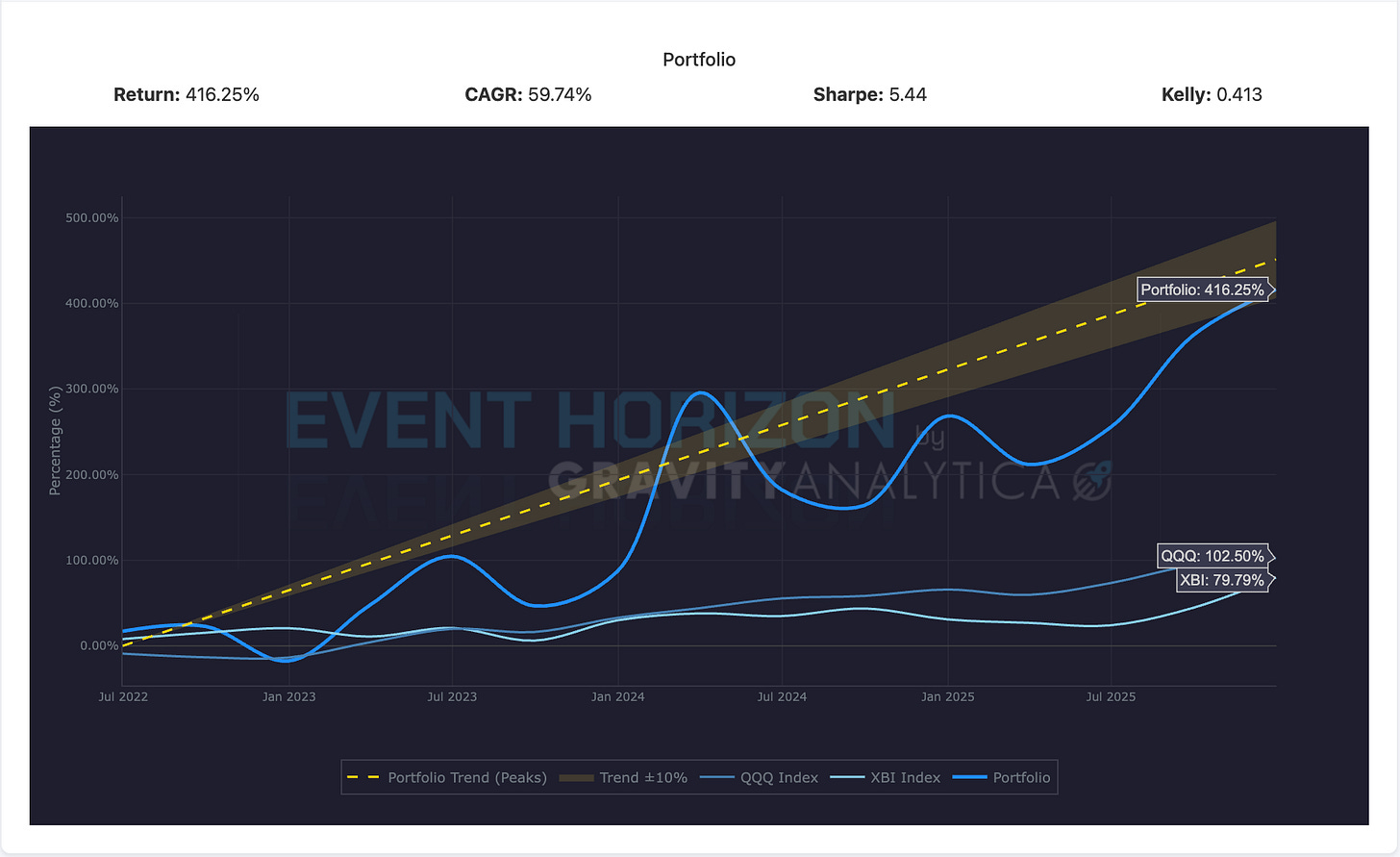

Test Account Returns

Day 967

Quarterly smoothed returns.

This account started with $100k and is now at $516k. This is taxable income - and I have been paying taxes the whole time. This account is still running and will continue to run until day at least day 1000.

1 - Standard brokerage, not a IRA/401k.

2 - No use of leverage.

3 - No options.

When you see people post returns you need to understand whether or not those are real returns or theoretical? Are they trading for a living, i.e. paying taxes on those returns, or are they trading in an IRA and making a living off from activities outside of trading?

Like running a YouTube channel, writing a Substack, getting referral commissions from exchanges, collecting fees managing other people’s money (Which is a good job by the way,) etc.

Keith Gill (The Roaring Kitty Guy) likely would not be famous if he was actually had to pay his mortgage and electricity every month out of a brokerage account. Taking on that risk without his and his wife’s income covering all their living expenses would have been a completely different scenario. With completely different stress.

That constraint would have changed the outcome. I lot of people see his returns and forget he was operating under a difference set of constraints.

Compounding in a tax protected account is a different game entirely when you don’t have to file quarterly taxes and lose 37% of your port to do so. Did you once see him on YouTube say, ok I have to sell stuff to pay taxes?

I didn’t. But maybe I missed it.

And most importantly you need to know, whether or not they are running 2-4x leverage to get those returns. As Martin Skhreli magnificently just demonstrated, leverage is a quick way to ruin but it’s also a sneaky way to hide the fact that the returns are elevated by having access to credit.

This is something all those famous money managers who write books tend to gloss over. They run leverage and don’t tell you about it.

The Sharpe Ratio is designed to show you which strategy is safest to run leverage. That’s the whole point of that analysis.

By the way, the actual non-smoothed Sharpe return for the test account above is ~1.05. I just noticed the header code has a bug.

Those famous traders who marginally over-perform the indexes for a decade or more were running 2-4x leverage. Something you likely can not do without getting divorced.

Constraints are most usually discussed in terms of ESG, fossil-free, weapons-free funds, etc. A constraint is when you actively restrict what you invest in for some extraneous reason. And they creep up everywhere.

I like to sleep in.

This means I have to decide on setting an ask which might be too low or just reacting to the market when I wake up and maybe wake up to see I have missed out on a huge spike.

This constraint dramatically changes my returns. If you trade in a different time zone or have a real job to go to you need to except that you will have such problematic constraints.

They are also part of life.

But, try to not add unnecessary ones onto the ones you can’t avoid. Soccer practice is fine. Ignoring an asset because you discount it’s value dismissively is not.

Buffett not buying bitcoin is an example of an problematic constraint that was self-inflicted. If you were managing $100B in 2012 your risk models would have permitted a $1M investment in bitcoin. A $1M loss is a rounding error in an account that size.

This is a completely different scenario than most people were in at the time.

Buffett didn’t have to understand bitcoin. I am sure he has bought his wife (and daughter) purses over the years and doesn’t understand those items either. He just had to understand there was a market for bitcoin and people enjoyed owning it.

Taxes, tax harvesting, are a problematic constraints as well. One unfortunately you can’t avoid if you live from income earned from the market. If you plan on earning a living trading you will have to begin to think about these time-based constraints at some point.

I’ve been running a different account in the US Financial Competition. This is a test to see if having monthly deadlines to submit brokerage statements affects the way I trade and because I realized that people need 3rd party verification. This is the internet. There are cats that ride killer whales here. So verification is necessary. And rightly so.

I’ve been paying some guy in California who used to run a softcore porno magazine to be that independent 3rd party. I realize this is strange and humorously ironic.

The account in the US Financial Competition returned 73.2% in 2023, 93.2% in 2024 and is up ~70% in 2025. I should subtract the three years of fees from the returns to be 100% honest here as to the returns. So 73.1%…

It started with ~80k which was the average retirement account balance at the end of 2022.

The answer to the question, Does being a competition affect the way I trade, is:

Yes.

Any constraint you put on your trading will hurt your returns. I know this - it is well documented in academic literature. And even though I know this it still affects me.

Which is annoying.

You would think after almost 25 years of this I would be immune.

But, I am not.

Time-based goals (goals are just constraints with a publicist) also interferes with decision making which is why this year I didn’t submit my brokerage statements until October. I just didn’t want to think about what I made that individual month. I now know it affects me so no reason to continue to subjugate myself.

This is one of the reasons why enforcing a day-trading only strategy causes you to under perform. Why stop-losses causes you to under perform. Because you are imposing a time-based constraint.

You need to be flexible.

If the trade takes 15 minutes - so be it. If it takes 18 months - so be it. Both Buffett and Munger have stated that if you can’t stand being down 40% you don’t deserve to make any gains. This I agree with.

No one complains about holding NVDA over the last 5 years. No one comments about “lost opportunity costs” in doing so. No one advocates for day-trading or scalping NVDA. And there were plenty drawdowns where a stop-loss woulc have knocked you out of NVDA over the last 5 years.

Find the right stock. Not the right “setup.” This is reality.

If you can find the right stock when it’s setup that’s a bonus. But, it’s been my experience this is very difficult to do. At least for me. I just play the odds.

I just have accepted that I my first entry is going to be wrong and I will need to make multiple subsequent entries.

It’s pretty rare something is so obvious I just go metaphorically all-in and walk away.

NVDA is up ~820% over the same time frame as the above chart for comparison.

I should have just bought NVDA. But, I know the returns I can get running my strategy.

(You may want to know what the strategy is: Buy on liquidity. Exit on risk.)

(In the account I managed I did ride QQQ calls through December 2024 so there is that. But, I personally didn’t trade tech in the last few years.)

NVDA was (at the time) higher risk.

I didn’t know some idiot would be proposing to his ChatGPT girlfriend a few years later or a lawyer would start preparing briefs using an LLM. I wholly under estimated the laziness of man and I wholly underestimated that the world would voluntarily relive the Video Game crash of 1981 on a trillion dollar scale.

I also didn’t know Enron and WorldCom’s accounting tricks would make a reappearance either. Though, frankly I should have seen this coming.

The point here is be wary of second guessing decisions just because what you did under performed what you didn’t do.

I few years ago (2014 roughly) I pulled the top returning trades from close to close. I.e. you buy a stock right before close and sell it right before close the next day. What would be the return if you guessed right for ~225 consecutive trading days and picked the highest returner for the next trading day?

You would have ended in possession of all the world’s money really quickly. There are literally a million or more ways you could have made more money than you did.

This last year, I skipped ahead financially and upped the account to $1M - I presume everyone will get to $1M soon enough. I don’t think I have to demonstrate you can get there in 5-6 years.

Because of this extra capital I have been running a hedging strategy as protection off and on. Mostly around Trump.

I adjusted the expected return up-slightly to account for this activity. Read this as I’ve taken on slightly more risk which means, since I exit on risk, I have been holding for a bit longer.

That’s it. I am just riding the winners a little bit longer than I was. That’s the Final Chapter big wow moment.

Just holding a little bit longer.

We will see if I still hit the 70% for the year or not. There is still plenty of time for Trump to invade France and ruin my returns.

Still just a standard brokerage, no use of leverage, just more money in it this round.

The goal of all of this is to show what is possible without taking on stupid risks and to show how far you can get if you just read filings and do a little bit of thinking. This is all geared towards showing an 11 (now 15 year old) how the market works.

This is why I started writing all this stuff down originally. Because I have one of those.

I don’t know if making $700k/year (~$450k after taxes) is enough for your desired lifestyle. I do know that is what 70% return on $1M is just to state want might not be obvious to anyone reading.

If you don’t try to grab the brass ring before your arms aren’t long enough to reach it you can really get anywhere in life.

-AJ