The Greatest Fool

The Greater Fool Theory states that people can profit from overvalued assets as long as they can sell them to someone else (a “greater fool”) at an even higher price. This idea was first described in writing by Burton Malkiel in the book A Random Walk Down Wall Street.

Let me explain with trading cards.

ACME Trading Card Company (ATCC) invests money to design, manufacture, package, distribute, market and sell Gravity Analytica Trading Cards. This is a foolish idea but they follow through. Not as foolish as selling ugly little monster key chains for $2000 but just because you can’t understand the value doesn’t mean there isn’t value.

People thought playing basketball was a dumb idea and now it’s a billion dollar industry. People that video games were dumb. People though bitcoin was dumb. People thought Pokemon cards were dumb. And people think Labubu are dumb… well that last one is pretty fucking dumb BUT Pop Mart is making a killing so had you invested in the company with this dumb idea you’d be shopping for an island right now.

Don’t discount dumb ideas.

Anyways, these cards are issued in single packs. Each pack containing one card. Understanding psychology, ATCC put randomly into a small number of packs inserts cards that are unique and special in the hopes that these cards become precious. (purposeful literary reference)

ATCC’s total cost per pack is $0.15. Just to put a number on it. The numbers themselves don’t matter. This is 100% at-risk capital. If these don’t sell they take a financial hit and may go out of business. ATCC borrows this money from investors. Investors whose friends think are dumb.

Now, you buy one of those packs and in it you find one of these special “rare” cards (maybe it’s got some of my hair on it) and you sell it immediately for $10.00 at the ACME Trading Card marketplace.

The company has made $1.00-$0.15=$0.85 or 666% return on investment (ROI) and you made $10.00-$1.00=$9.00 or 900% return on your investment. My guess is you won’t file that gain on your taxes either. So your ROI has crushed. Congrats!

This continues. Sale after sale.

The person who bought the card from you sells it for $20. And then the card sells for $30 and on and on until someone pays $100 for it.

Then something unexpected happens. Something that based on recent history would be a seemingly impossible event. No one is will to pay more for it.

The chain breaks.

If you add up all links the total money in this chain is $100. The amount the last buyer paid. Everyone understands this. There is nothing complicated here.

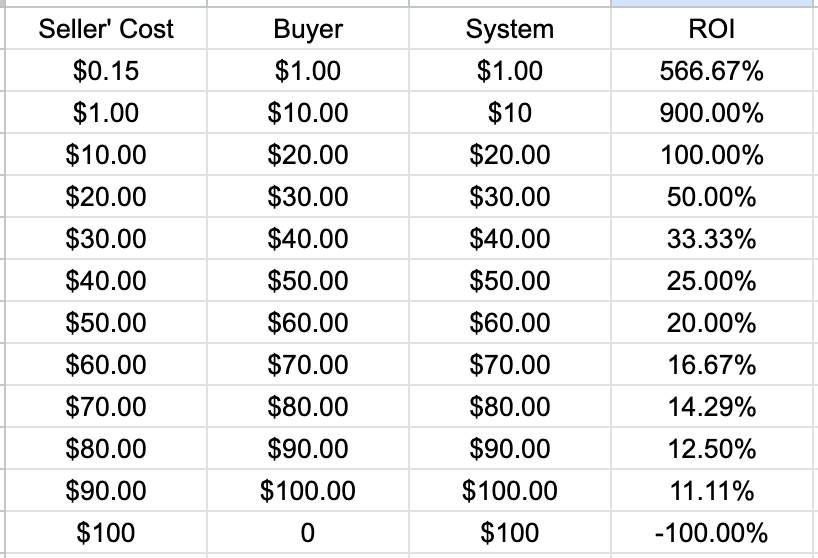

As a chart.

There is a lot to see in this chart.

First, the rather obvious fact that in this system is that the risk increases at each chain and the ROI decreases. You made 900% the last seller made 11%. The amount of capital you risked was $1.00 the last person risked $100.

Second, a rather less obvious fact is that the last buyer in the chain, to use the parlance of the stock market, the bag holder, is the ONLY person who contributes money to this system. Everyone else takes money out of the system.

One person takes a total loss on capital so that ten people and one corporation all make money. The reported final sale of $100 is what is going to make the news though. Not the total loss. Anyone followed up on all those NFTs that sold for millions to see what happened since? I can’t remember any interviews with anyone talking about how their NFTs are now worthless.

In reality this market would go up and then back down so that loss would be distributed to each person buying after the peak. But, you should think about in the terms I have explained. The NFT craze is a bit of anomaly in that it just abruptly ended.

What is hard to see in this chart and that is never talked about is that every person except the last link in the chain makes money and feels they made a good decision.

Did they? Is there any inherent value in this product at all? Could the chain have stopped after two or nine or nine hundred? Is there any reason why one person is the goat (as in eaten by the T-Rex. Different literary reference) and nine people feel like the GOAT (as in the best investor ever!)

This system made a whole lot of happy, potentially arrogant people. And one really cranky possibly divorced person. So potentially two really cranky people.

These sort of markets produce a disproportionate amount of people who believe they are smart but are just fortunate. And, in this example, produce one person who feels like a dumbass. Not always, but a lot of the time, a person’s first asset purchase turns out to be near the end of the chain. As you learn investing you are drawn to the most publicized assets. Then ones that have already run.

A person’s first investment may make a profit only for you to watch the value plummet right afterwards. Or it might make you a bag holder. Either way, this will change how you view future investments. Often if that person returns to the market and repeatedly ends up losing money the will begin to think that the market is a scam. Which, in truth, all asset markets are scams.

That person will reject the idea of markets entirely. They will not reject the idea that they never understood the market in the first place. This happens in social / dating markets too especially if you are rejected early (and often.)

This is the Greatest Fool.

The Greatest Fool will start to follow podcasts and YouTube channels and read books about financial armageddon and the collapse of financial systems. Instead of investing their money to make returns they will give away their money to buy things that will only have value if the world ends. Like personal fallout shelters, bunkers and backpacks full of gauze and MREs. Courses on being an Alpha male.

If the world ends what good is a backpack full of MREs? You will just starve next week. Instead of this week.

Rarely, but sometimes a person’s first asset choice is a really, really good one. Bitcoin made a lot of complete morons millionaires. GEICO was Benjamin Graham’s first investment. And really it was his only good investment. Benjamin Graham also is one of the truly rare, probably unique people, whose first investment he held long enough to become a bag holder. It was a chain of length one. He rode GEICO all the way up.

And all the way back down to his original investment.

But, luckily by then he had sold millions of books extolling his investment strategy. A strategy that never worked for him because is investment in GEICO violated his own strategy.

Now the faster the market develops the faster these Greater Fools get created. Bitcoin arose from the extremely fast collapse in silver, gold and housing in 2008. The progenitor of bitcoin cypherpunk arose out of the collapse of the tech sector.

The collapse of the tech bubble created so many Greatest Fools that the stock market didn’t recover for 14+ years. People just avoided it. The housing collapse did the same thing to the housing market and created a generation of renters.

But, this isn’t new. Back in the 80s the coin market imploded mostly because of shady operators and that wiped out the majority of the coin industry until COVID.

In the 90s the baseball card market imploded. Because of shady manufacturers. Or rumors of shady manufacturers. And because of shady operators in the autograph markets. Again, that market was basically dead until grading companies (the same force that caused the implosion in the coin market) showed up and gave credibility to those collectibles again. If you are interested in this there are documentaries on both fraud in the autograph market and alleged fraud by Upper Deck in regards to Ken Griffey Jr rookie cards.

Manufactures, dealers, promoters, distributors, (brokers, dealers, investment banks, etc) want buyers of their products (trading cards or stock shares) to win often enough they keep that undue confidence that comes from just being in the chain predicted by the Greater Fool Theory.These facts are the primary reason why ACME Trading Card company tries so hard to make sure that the market for their cards doesn’t implode very quickly. This is something Wizard of the Coast (Magic the Gathering) actively pre-empted when those cards started to become collectibles and not just a game. This is why players have to use only new cards and cards are retired.

This is also why regulation is so important. Whether it’s quality product control or the SEC. Because, markets (all markets) need to create the illusion that the participants are smart. That they are making good choices, good decisions and that they are in control of their own financial future.

But, if consumers (have to use at least one economic word) get burned and give up on the idea of markets then ACME can’t make money selling totally worthless cardboard.

The house of cards that is all capital markets collapses quickly when trust is lost.

Though there are always people willing to sell you bar of silver to put in your closet so you don’t ever have to accept some people always lose money in asset markets. But, the odds are pretty good overall you will do just fine. As long as you never think you are smarter than the market.

We are reaching that moment where everyone participating in every market thinks they are very, very smart.

But, not a sign of a problem per sec. Just a sign that these markets are well regulated.

But, I am still very, very concerned.

- AJ