There can be only one.

Essentially, we run a Zero-Intelligence Trader. We use the model to constrain when we buy based on the EM channel and exit based on the event landscape. Very rarely do any of the human parties involved know the name of the company before we enter. I didn’t know what IOBiotech’s drug even did until about a month before the Phase 3 trial results were released.

The only “intelligence” in the system is macro economic awareness which is used to add or removing hedging to the accounts, controls cash levels, etc. and the only analysis I do is after we have entered to try and pick which positions we want to rotate into first if there is any drift or drawdowns. When one position moves through its exit that cash has to go somewhere. Into a new position or into an old position? And, I am quite bad at this.

I can personally attest that it is impossible for any of us keep track of 150 (or more) companies at a time no matter how organized you are. And even my BEST/BETTER/GOOD/AVOID list gets stale after a quarter or two and is just something to keep me occupied.

In reality, we play the odds and don’t think too much about it. In fact no one but me even thinks at all about it.

But, in order for our strategy to work there needs to be a fresh supply of stocks. And, there hasn’t been very many IPOs in 2025, especially in the biotech space so our candidate list for 2026 is shrinking so we are having to extend our exits. And, with the bond market pricing in 75 bps cuts this year and the odds of Santa Claus flying out of Jerome Powell’s butt still very, very low, we are trying to be selective about which stocks we run higher risk on.

By extend, I really mean think about the companies we own.

So for the last 12 months we have been identifying people smarter than we are to help decide when to hold beyond our event engine’s prediction and have been building out a new AI decider.

Here are six stocks for your consideration. We own all of these. Question for you at the end.

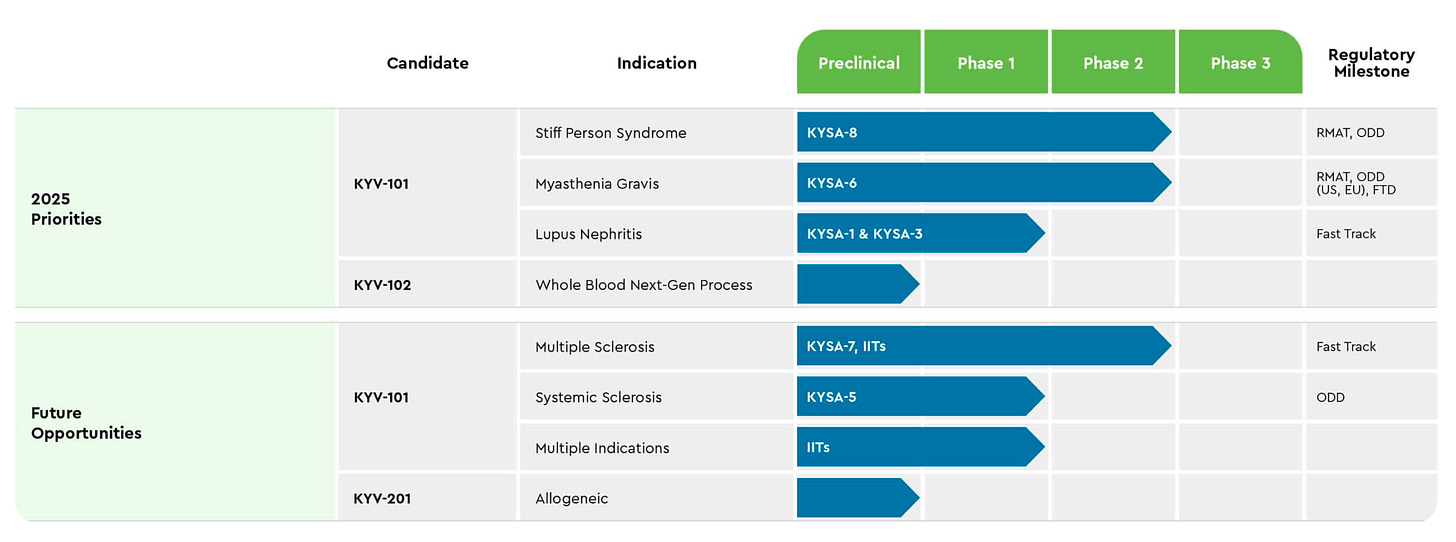

KYV-101 Multiple Sclerosis (MS) and Rheumatoid Arthritis (RA)

MS: Report Phase 1 IIT data in Q3 2025

RA: Report Phase 1/2 IIT data in Q4 2025

KYV-101 Myasthenia Gravis

Report interim Phase 2 data in Q4 2025

Initiate enrollment for registrational Phase 3 trial by year-end 2025

KYV-102

IND application in Q4 2025

KYSA-8 Stiff Person Syndrome

Report top-line registrational Phase 2 data in 1H 2026

BLA filing in 1H 2026

KYSA-1 and KYSA-3 Lupus Nephritis

Report Phase 1 data in a peer-reviewed publication in 2026

Kyverna reported $211.7 million in cash, cash equivalents, and marketable securities as of June 30, 2025.

Kyverna has multiple drug trials and clearly defined event/catalysts in their press release.

TH-103 Neovascular and Exudative Diseases of the Retina

Report initial Phase 1 clinical data expected in Q4 2025

June 30, 2025, Kalaris reported cash and cash equivalents of $88.4 million

Kalaris has one only drug.

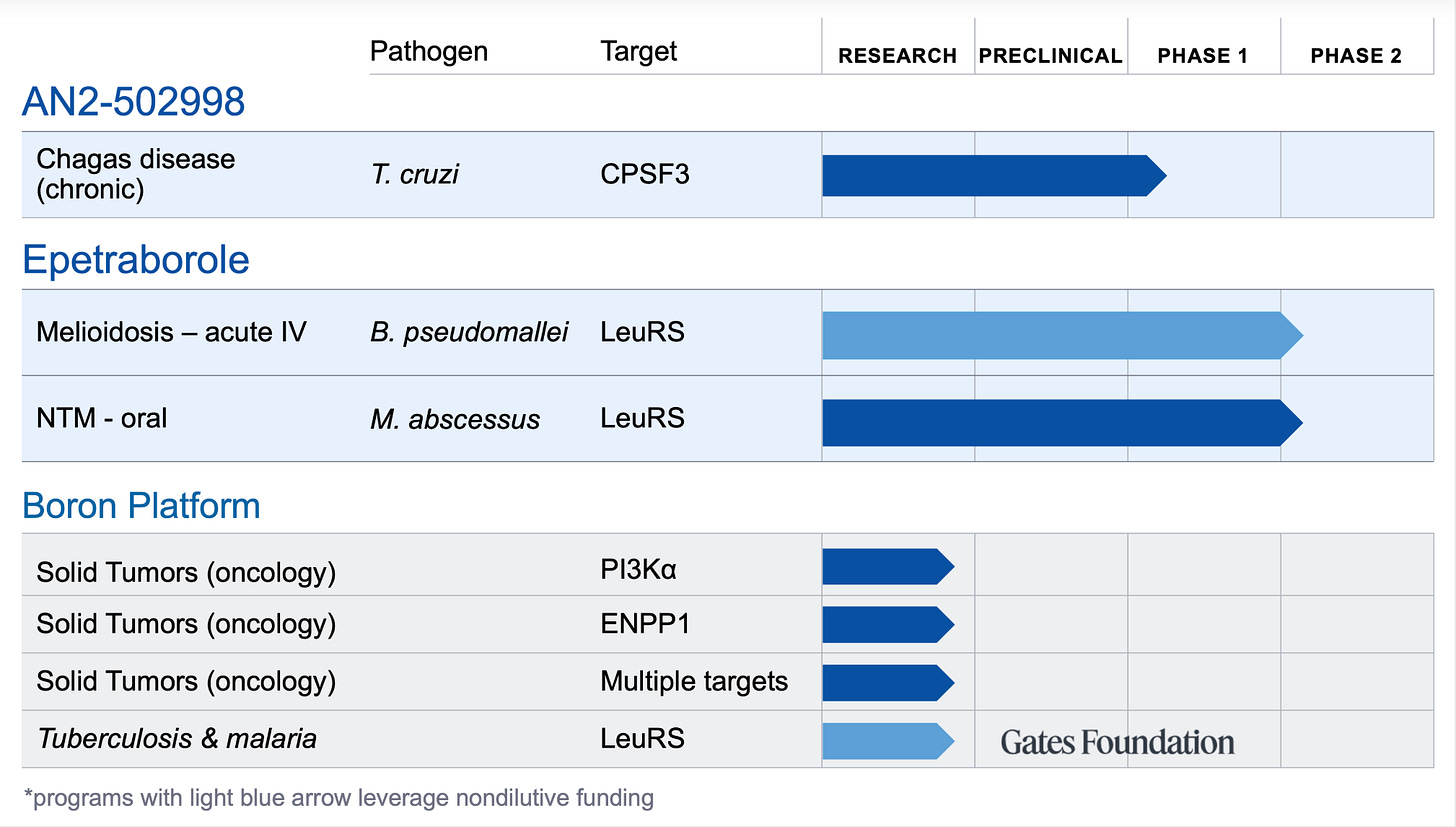

AN2-502998 chronic Chagas Disease

The company did not state a trial timeline but we can infer data for the Phase 1 is to be released before Summer 2026

AN2 Therapeutics reported cash, cash equivalents, and investments of $71.2 million at June 30,2025.

AN2 provided very little information and did not present the information very clearly in their press release. Gates Foundation is an investor.

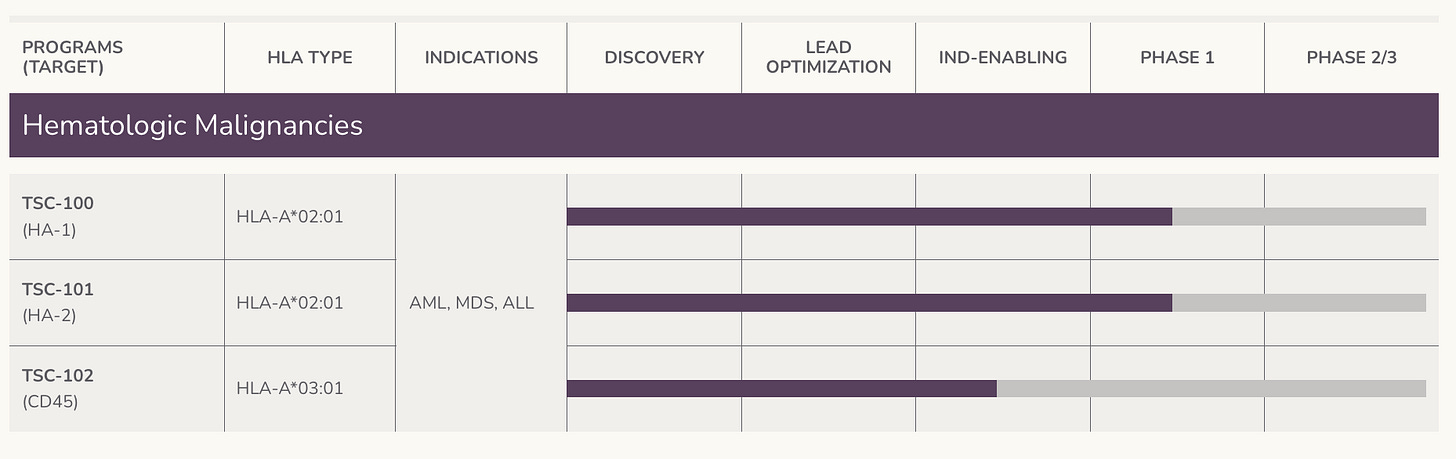

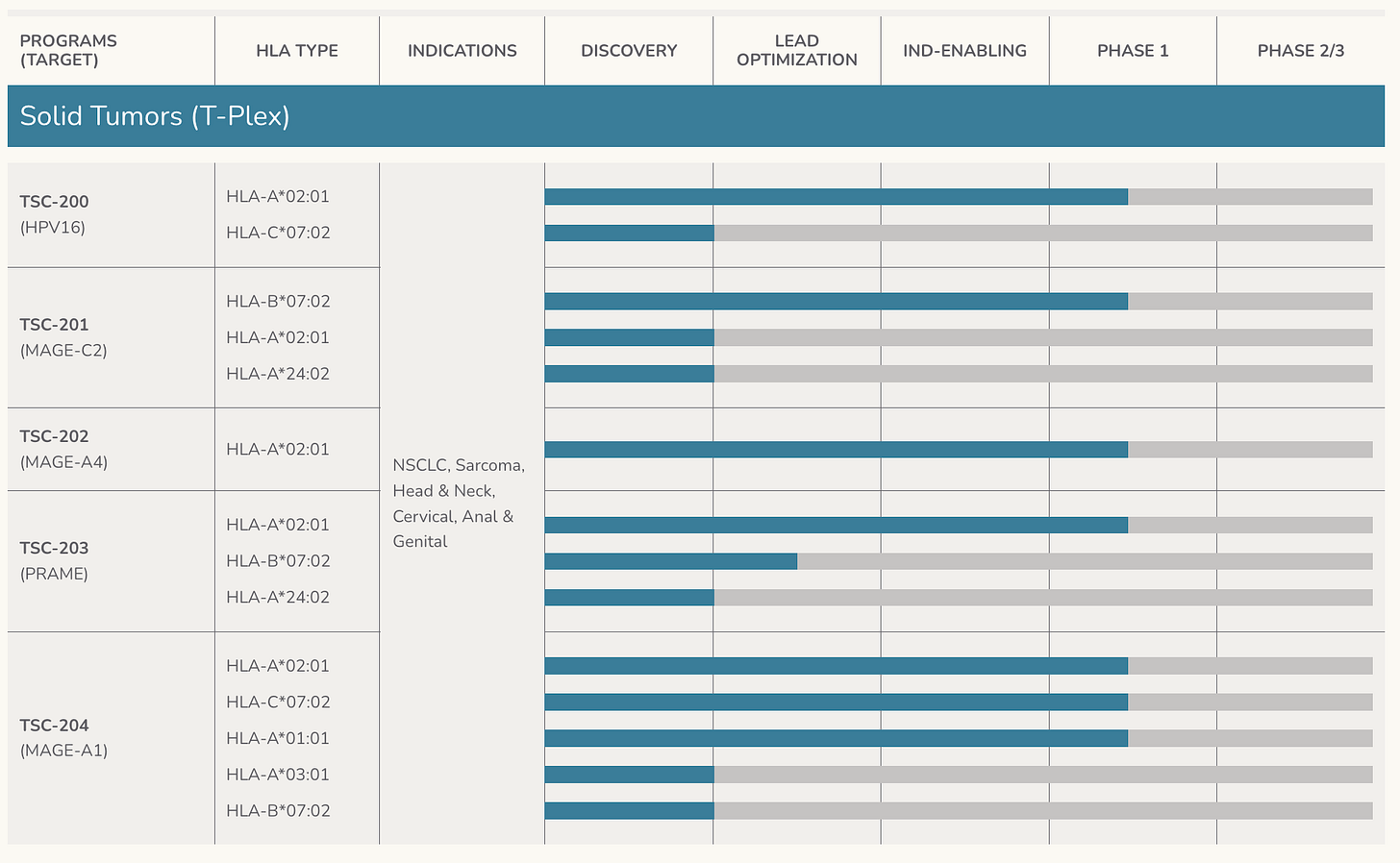

TSC-101 Acute Myeloid Leukemia (AML), Acute Lymphoblastic Leukemia (ALL), or Myelodysplastic Syndrome (MDS) undergoing allogeneic hematopoietic cell transplantation (HCT)

IND application for TSC-102-A0301 in the second half of 2025

Present additional Phase 1 trial data by the end of the year

NCT05973487

Expects to dose first patients with multiplex TCR-T in the third quarter of 2025

Plans to share initial safety and response data in the first quarter of 2026

Tscan reported cash, cash equivalents, and marketable securities as of June 30, 2025 of $218.0 million.

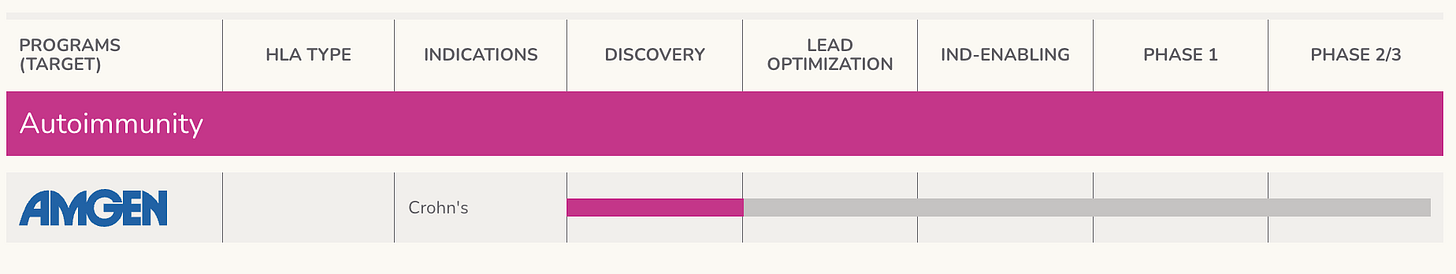

Very robust pipeline, but a lot of active institutional selling. AMGEN is associated.

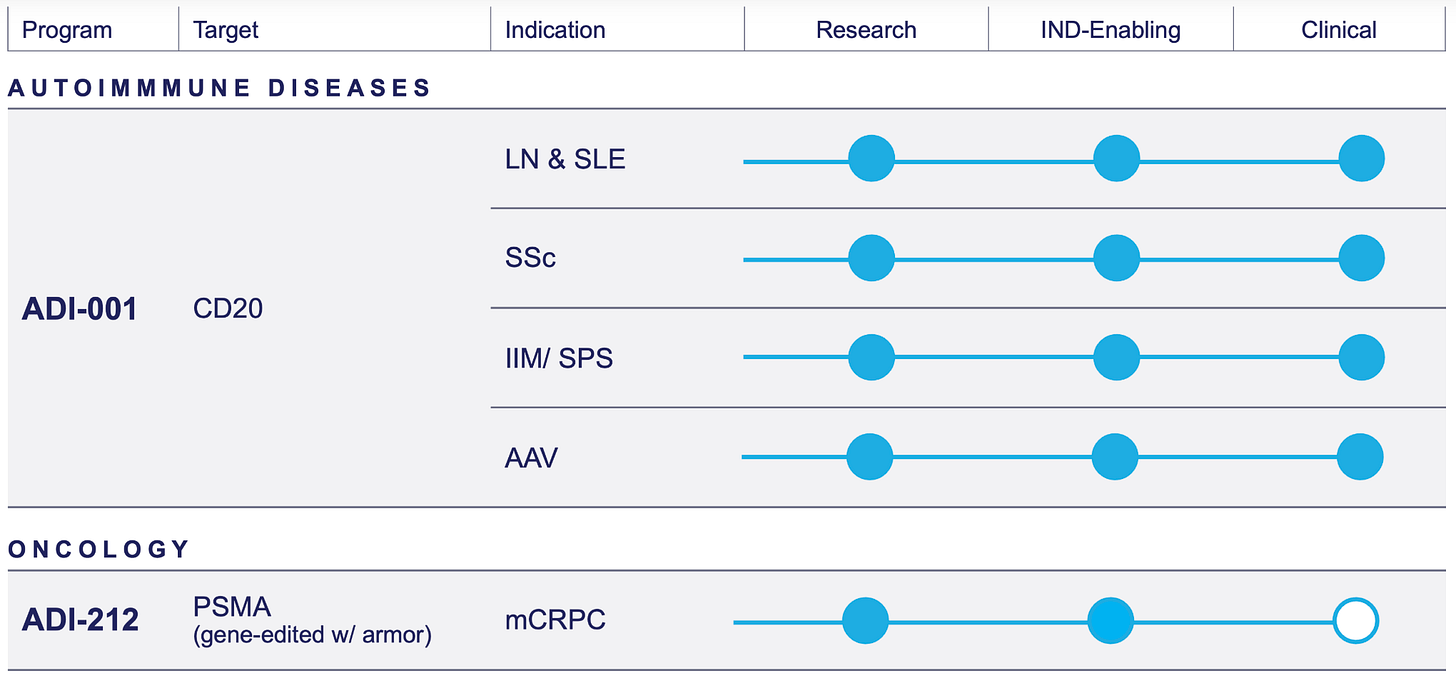

ADI-001 Autoimmune Diseases

Preliminary clinical data from the Phase 1 trial in the second half of 2025

ADI-212 Prostate Cancer

Initial clinical data from this program in the second half of 2026

Adicet reported cash, cash equivalents and short-term investments were $125.0 million and that it recently discontinue the development of ADI-270. Basically a single drug.

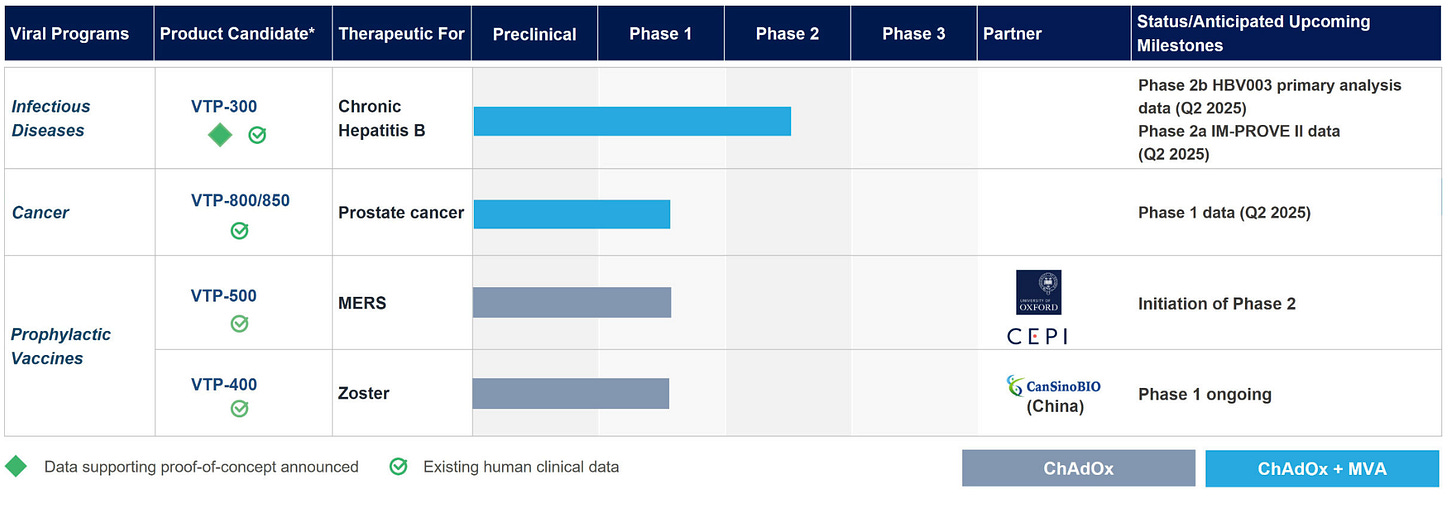

VTP-1000 Celiac Disease

Phase 1 data is expected early in the fourth quarter of 2025.

VTP-1000 MAD

Data is expected in mid-2026.

Phase 1 trial of VTP-850 in patients with prostate cancer

Attempting to find a partner.

Barinthus reported cash, cash equivalents and restricted cash was $87.8 million. This company is an ADR with ties to Chinese biopharma.

In honor of Henry Cavil’s Highlander reboot. There can only be one.

So which of these stocks is going to have the highest return between Monday 18 August, 2025 and 31 December, 2025?

And if you are brave put them in order 1-6.

( ) $KYTX

( ) $KLRS

( ) $ANTX

( ) $TCRX

( ) $ACET

( ) $BRNS.

Leave your thoughts and guess in the comments.

As always, if you think there are spelling errors update your dictionary to the latest version. Happy speculation!

— AJ

We can be found on Twitter.

Or in Chat.

Our charts are updated everyday as new data becomes available and are available via subscription. This is because the costs of doing this analysis across 15,000 US-listed securities is not cheap. Compute is not cheap.

Neither is the effort required to find these plays before they move. If you do nothing but read all day, every day, you can beat the market. But we prefer to sleep in and therefor use code.

1. KYTX multiple Q4 data/IND, two big conference run-ups

2. TCRX

3. BRNS

4. ACET

5. KLRS

6. ANTX