What Happened Today?

Monday December 8, 2025

Macro:

Not much. Just… 10 yr Japan bonds hit 1.972. There will be a psychology gut check at 2 which I presume we will hit by Friday.

The carry trade will be effectively wiped out when the Fed cuts Thursday. It’s just unknown if that trade has already unwound or not.

With the FOMC decision and more importantly the press conference on Wednesday the first half of this week is going to be low bid pressure. So I just shorted the open.

Tomorrow’s JOLTS data I don’t think matters to the Fed at this point. It might spook the market briefly though.

Crypto:

Saylor’s Strategy MSTR 0.00%↑ disclosed it bought another $1B in bitcoin last week.

In March of 1980, three brothers attempted to corner the silver market. Their understanding of supply and demand predicted that if they could buy enough silver they could force a persistent short squeeze and spike the value of futures contracts. And they were right. If only they had enough cash to do this with borrowing they could have made a lot of money.

This is the same basic principle that Archegos used and that created the GameStop phenomenon. Archegos also had to borrow massive amounts of money from multiple banks at high leverage. GameStop just needed all of sports gambling to shut down temporarily. Regardless, you can’t squeeze an asset on your own.

At one point the Hunt brothers owned nearly 1/3rd of silver held by non-government bodies. But unfortunately market forces decided to act against them. The risk the brothers were taking on was deemed too great so margin rules were adjusted and then Tiffany’s Jewelers enraged the necklace mafia and it was over.

Silver fell 50% over a week and wiped the brothers out entirely.

Now Strategy isn’t buying on leverage. Saylor is using simple debt and selling shares. But, his game is the same. He is trying to tie up the liquid float as much as possible to drive a short squeeze.

Currently, the company owns 660,624 BTC. There is about 15M bitcoin that is held in active or potentially active wallets. The rest are lost. So that’s 4% of the float. Saylor only needs to 5x his position to secure a victory. At current prices he only needs to raise another $216B which means selling another 1.2B shares without any price change.

Or he can attract another $216B in HODLERs.

Micro:

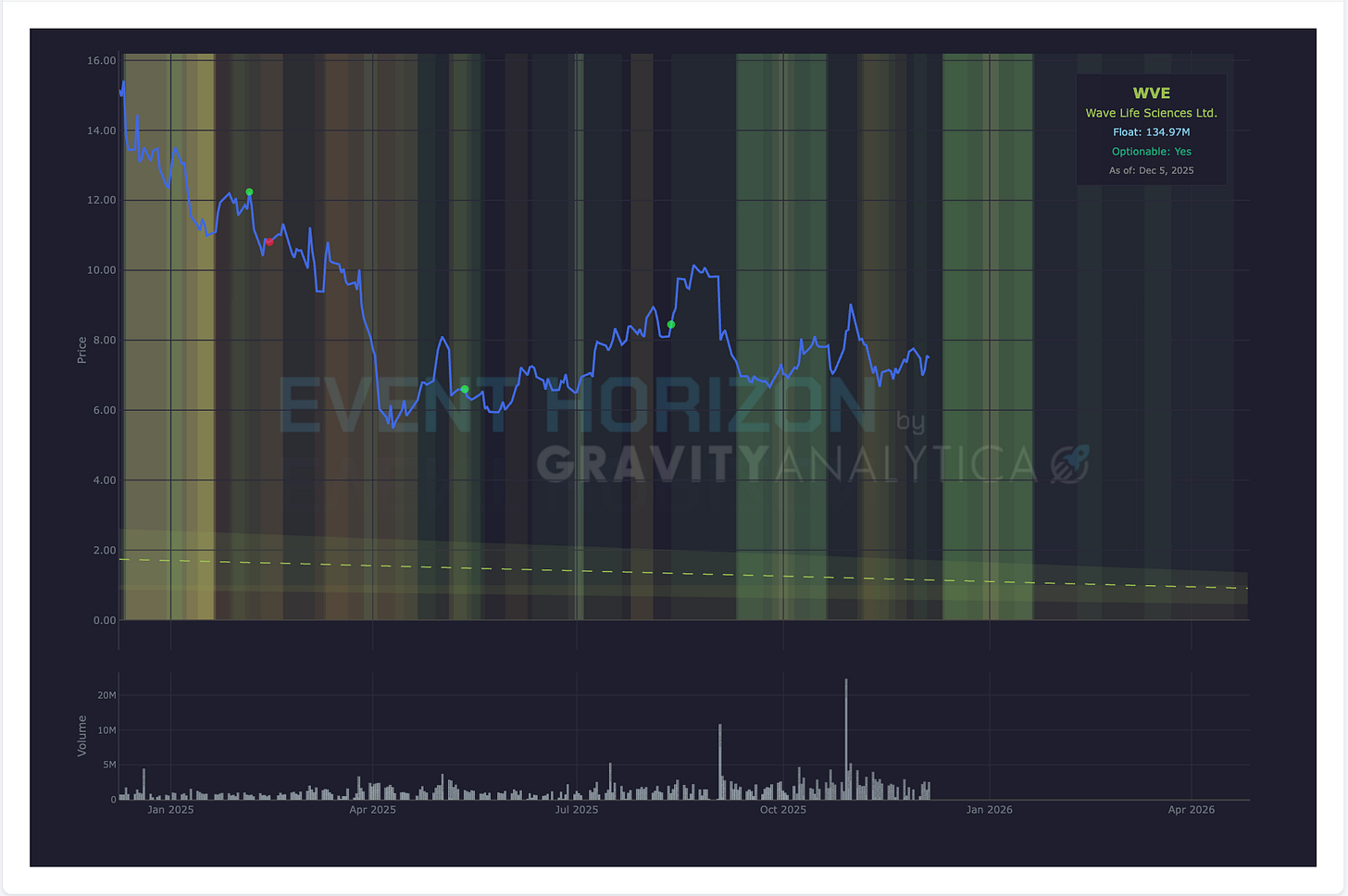

Wave Life Sciences WVE 0.00%↑, Fulcrum Therapeutics FULC 0.00%↑ and Structure Therapeutics GPCR 0.00%↑ all released data a bit earlier than the code predicted.

Wave and Structure are weight loss drugs which continues to be the en vogue narrative. A competitor in this space Fractyl Health GUTS 0.00%↑ was down early in the day then rallied.

It’s good for humanity that GLP-1 similars are so easy to create but competition is going to drive down long term value here.

HoldCo Asset Management, founded by Vik Ghei and Misha Zaitzef who have a long history of being asshats IMO, went after the CEO of Keybank KEY 0.00%↑ for using capital to make acquisitions instead of buying back shares and is threatening a proxy fight.

I am not making a prediction here, but if I was the CEO of Keybank I’d want to shore up the stock price.

On a similar thread, Apple executives are fleeing en mass because Apple is being cautious about AI. This is all very me-me short-term thinking. Apple has the only platform that matters to the attention span economy and I think they have been very smart to avoid spending cap-ex on AI.

And lastly, Paramount PSKY 0.00%↑ entered a hostile $108B bid to acquire WBD 0.00%↑ after Trump said he didn’t like the Netflix NFLX 0.00%↑deal. David Ellison is spending money like it’s printed by Milton Bradley.

This is akin to putting money in the jukebox on a sinking ship. Hollywood is dead. Long-form creative content has become background noise. And YouTube just does it better.

Unless Paramount finds a way to wedge gambling into the next Harry Potter series and don’t see how this makes any financial sense.

But, Larry Ellison is getting his full measure out of his campaign contributions so at least we know our political system is working as intended.

These executives (Saylor, Ellison, Altman, Zuckerberg, Musk, etc) all appear to be actively trying to reach the “too big to fail” threshold. These numbers really don’t make sense otherwise.

This is analogous to the movie Speed. There is a gap in the road ahead and you know you can’t stop so you just decide to hit the accelerator because physics doesn’t apply in cinema.

We all get to find out of debt is a real physical force.

Or not.

Precious Metals:

Rumor is dealers are refusing to buy at spot again for silver.

The everything bubble, which started out as descriptor of just the bubble in equities from passive investing, is now literally every asset class. There is no place to hide here.

We own Fractyl Health and are considering taking out a short position on silver. And will trade options around the FOMC meeting press conference this week.

If you like our risk/event charts they are available in chat via subscription. This subscription fee covers the cost of running all this code. Amazon Web services and data plans are not cheap.

As always, if you think there are spelling errors update your dictionary to the latest version. Happy speculation!

— AJ

DISCLAIMER: DO NOT BASE ANY INVESTMENT DECISION UPON ANY MATERIALS FOUND ON THIS WEBSITE. We are not registered as a securities broker-dealer or an investment adviser either with the U.S. Securities and Exchange Commission (the “SEC”) or with any state securities regulatory authority. We are neither licensed nor qualified to provide investment advice. Our website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Past performance is not indicative of future results. The material contained on this page is intended for informational purposes only. GravityAnalytica.com is wholly-owned by Gravity Analytica, LLC. Our website is not an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content of our website and/or newsletter is not provided to any individual with a view toward their individual circumstances. While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained on our website is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between the any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment. We reserve the right to buy or sell shares of any company mentioned on our website or in our newsletter at any time. We encourage you to invest carefully and read investment information available at the websites of the SEC at http://www.sec.gov and FINRA at http://www.finra.org.

The company or individuals affiliated may hold positions or may enter into, or exit, positions on any equities at any time. This website and materials found on this website, or in any communication, are meant for individuals of eighteen (18) years of age or older and are not suitable for younger audiences. Materials and information provided on this website and in any communications with or from Gravity Analytica LLC, it’s employees or affiliates, are for personal education use by subscribers and may be not be used in any regard in competition with this website or any other product or service offered by Gravity Analytica LLC. Past results do not predict future returns. IF YOU DO NOT AGREE WITH THE TERMS OF THIS DISCLAIMER, PLEASE EXIT THIS SITE IMMEDIATELY. PLEASE BE ADVISED THAT YOUR CONTINUED USE OF THIS SITE OR THE INFORMATION PROVIDED HEREIN SHALL INDICATE YOUR CONSENT AND AGREEMENT TO THESE TERMS.