What happened today?

Friday December 5, 2025

My day is over. Going hiking.

Macro:

Japan 10Y Bond Yields continued to move up all day breaching 1.95%.

PCE came in as expected. Which is neither good nor bad. It means the market will need hand holding next week until the FOMC decision.

If PCE had come in light and under 0.2% M/M we would still have a rally in small caps. But, coming in at expectation snuffed the optimism. Plenty of time this morning to exit calls and switch to PUTS to play the low bid scenario which followed.

And, likely will persist into next week which is keeping up with the prediction I made a few days ago.

Volatility is volatile. So you need to be prepared for the market to change it’s mind. Day-trade if you have to.

Everyone needs to be on SCOTUS watch for any hint as to the outcome of the tariff lawsuit. With COSTCO filing a new one and prediction markets 3 to 1 against tariffs it seem likely tariffs will be over turned.

How this is going to affect the market is really guesswork. But, the bond market is likely to have a tantrum as will the dollar.

Micro:

Smith & Wesson earnings beat expectations and soared +20% But, expectations were really low. Absolutely no signals have tripped on this company in the last year. There is evidence that people buy guns when Democrats are about to win elections. This isn’t a company we would trade but it is a company people follow.

Similarly, ULTA 0.00%↑ jumped 13+% after issuing strong forward guidance.

Uh… people tend to buy makeup when they are looking for a change. It’s called the Lip Stick Effect.

I don’t necessarily believe either of those theories. But, a lot of people do. And a herd of lipstick wearing, gun toting buffalos can easily ruin your day.

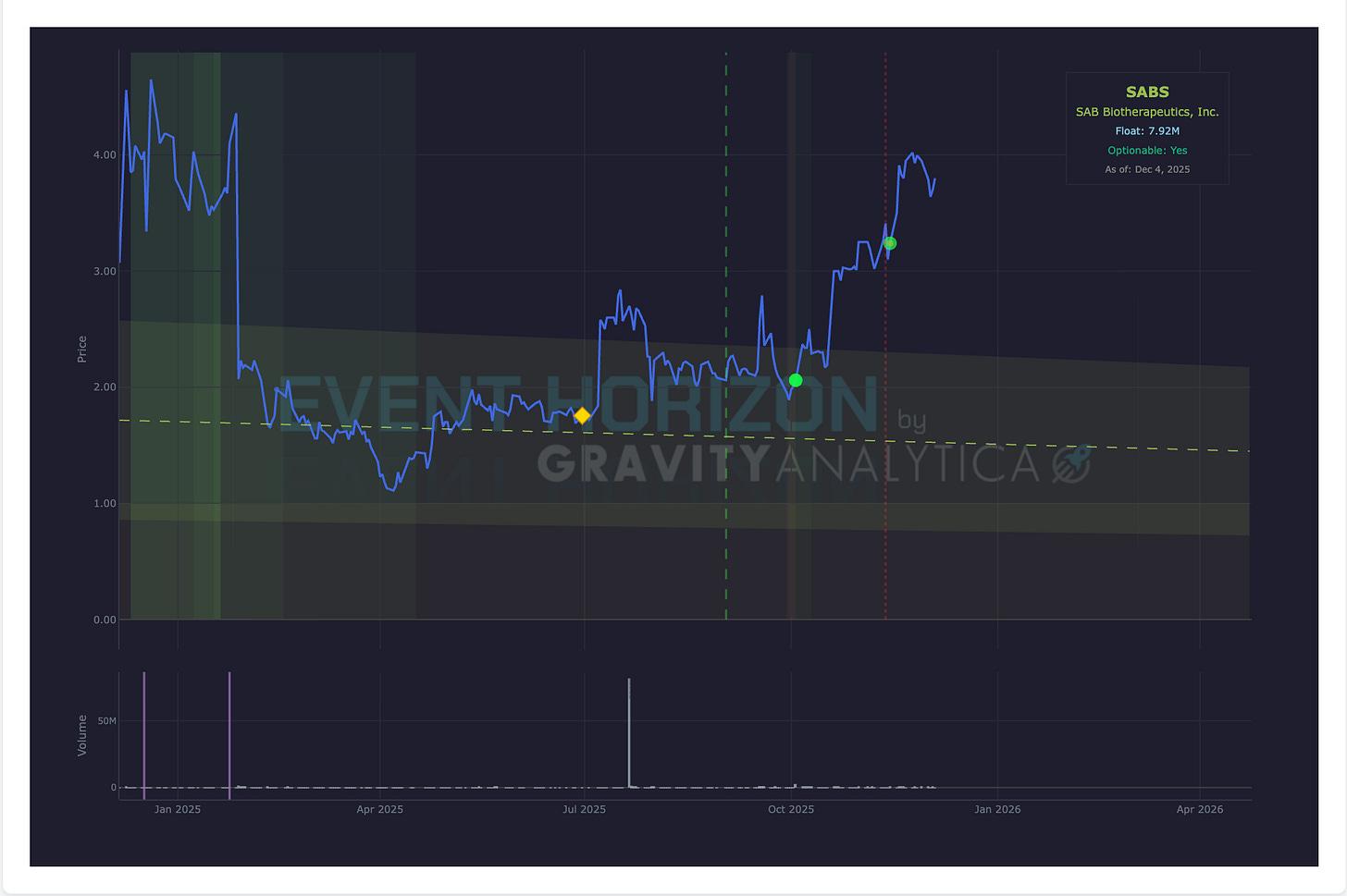

Both, GUTS 0.00%↑ and SABS 0.00%↑ showed continued strength post their accumulation signature alerts (gold diamond.) We still own both.

Crypto:

Bitcoin fell as you would expect since it to is sensitive to interest rates and needs free money to exist. Still no ∆liquidity signature has appeared.

Sonnet BioTherapeutics completed it’s merger and is now trading as PURR 0.00%↑ . Our system has not updated to the new stock symbol yet but here is the chart up-to-date to the last trading with the old symbol. This tripped accumulation then took off. And then dumped hard. There were a few ∆liquidity alerts before elastic moves.

A pump-and-dump is the opposite of a box setup. I should call a box setup a dump-and-pump.

Hyperliquid Strategies Inc (NASDAQ: PURR) is a digital asset treasury company whose primary focus is to maximize shareholder value through accumulating HYPE, the native token of Hyperliquid, a high-performance blockchain custom-built to house all of finance. HSI aims to provide capital-efficient and productive access to the HYPE token for U.S. and institutional investors, generating compounding shareholder returns that individual holders may not be able to replicate through staking, yield optimization, and active ecosystem engagement. HSI is positioned to become the largest HYPE-focused digital asset treasury vehicle capitalizing on Hyperliquid’s rapid growth and providing exposure to one of the largest and fastest growing revenue pools in digital assets. For more information, please visit www.hypestrat.xyz .It’s one to monitor closely because there are a lot of garbage men with farmers tans and gaudy gold watches involved here.

The new website still re-directs back to Sonnet’s old site so that shows there was no real plan or existing business and that company blurb reads like bad AI. Speaking of…

AI:

I dumped this year’s trading activity in the speculative account and asked Claude to analyze the results. We have traded 203 securities this year in this one account. I could dump the others and aggregate it but I am pretty sure the analysis results won’t change much.

I don’t think LLMs are helpful for making decisions but the certainly can help you understand and get clarity on the past and there is benefit to getting a third party review on your strategy.

Even if that third party is a disembodied chat bot.

So here some of Claude’s findings on the way I managed this account. This is very helpful as I can tune my re-entry strategy.

Your Exit Timing is EXCELLENT:

- 80.8% of stocks dropped 5%+ after you sold

- 71.4% dropped 10%+

- 52.7% dropped 20%+

- 39.9% crashed 30%+Claude spits out pretty detailed reports as well if you ask it nicely. Here is a snippet of one of these report. This also shows how actively we work to lower costs. It’s enthusiasm is irksome!

#### PYXS (Pyxis Oncology)

You traded this 17 times! Pattern:

- Sell at highs ($4.61, $4.33, $3.97)

- Stock drops 10-20% within days

- Perfect for buy-back strategy

#### CTMX (CytomX Therapeutics)

24 trades total! Pattern:

- Very fast drops (1-2 days)

- Sold @ $4.41, dropped to $3.35 next day

- Excellent candidate for quick buy-backs

#### ARTL (Artelo Biosciences)

Multiple sales @ $20-26 range:

- All dropped 60-84%!

- Crashed from $26.77 to $4.20

- Masterful exitIf you like our risk/event charts they are available in chat via subscription. This subscription fee covers the cost of running all this code. Amazon Web services and data plans are not cheap.

As always, if you think there are spelling errors update your dictionary to the latest version. Happy speculation!

— AJ