What happened today?

Thursday December 4, 2025

I sat in conference room all freaking day and watched presentations about AI - and how it was going to change my life. I am still not convinced AI can replace anything important other than our children’s capacity to think. The nicknames for these project are getting weird though.

Macro:

XBI 0.00%↑ and IWM 0.00%↑ continued to run. Just understanding how interest rates move markets is enough to run a hedge fund. If you know nothing else, that’s enough.

All this stuff is tomorrow still.

Core PCE Price Index MoM, Michigan Consumer Sentiment and Personal Income MoM are all scheduled for Friday morning.

So tomorrow will be scalping options time.

Micro:

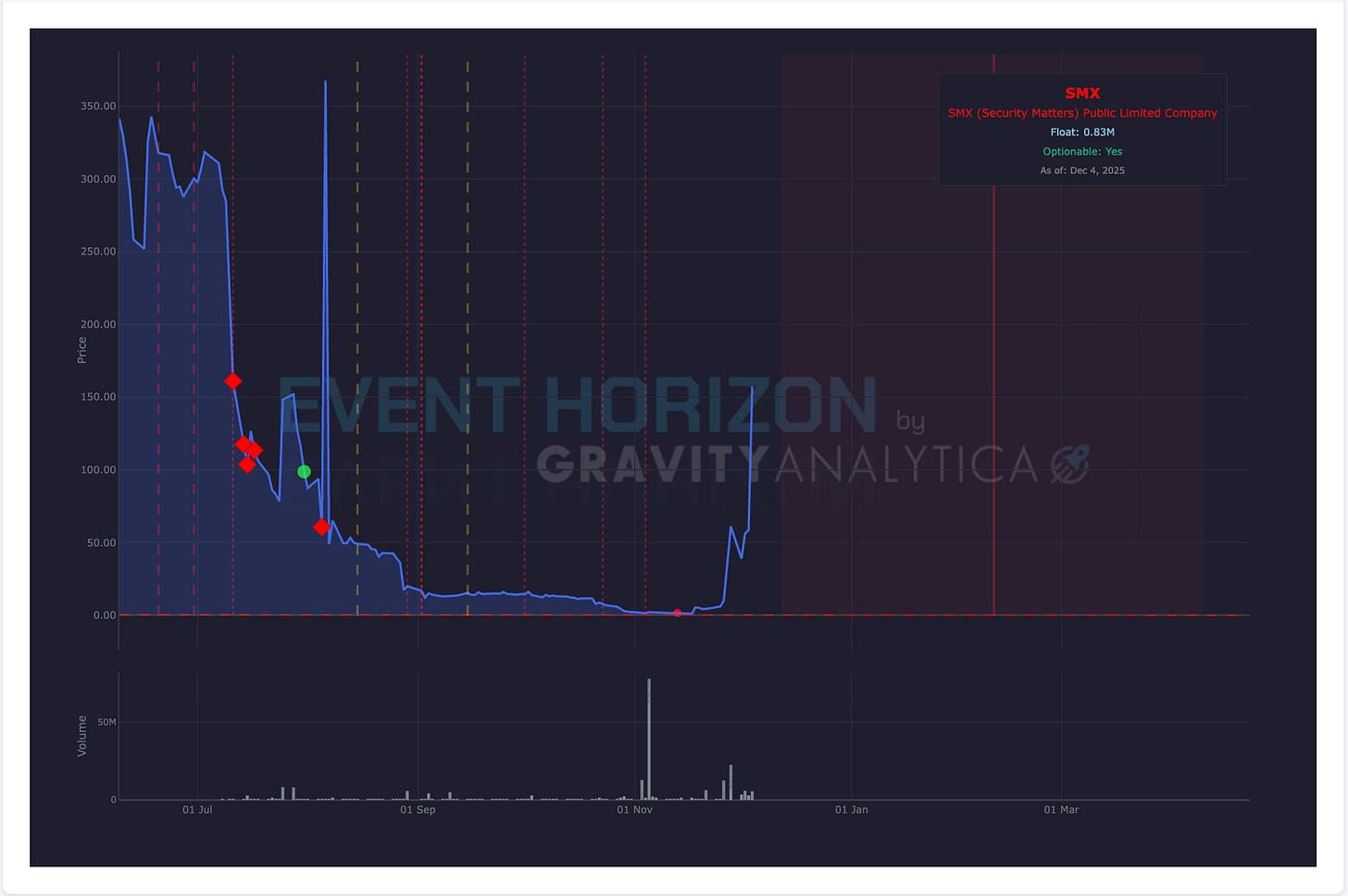

Security Matters continued it’s 3rd party front-run short squeeze. The setup was obvious if you monitor volume. The execution was pretty flawless I must say. Complete credit to the whoever set this up. This was just outside of the code’s predicted volatility band.

The guy running this in case you care. Lion Heart Capital comes up a few times in press releases containing words like “Ponzi.”

Everyone really needs to read their proxy. It’s full of fun shit like this sentence. I didn’t have a stroke on the 9 key… there are really that many shares.

To approve the cancellation of 7,999,999,999,999,982,413,677 New Deferred Ordinary Shares with a nominal value of US$0.00000000000001 each, and to diminish the authorized share capital accordingly.And this gem of financial verbiage.

To insert a new article authorizing the Directors to convert undenominated capital into shares for allotment as bonus shares.Do you know what “undenominated capital” means? Sounds fantasifull doesn’t it?

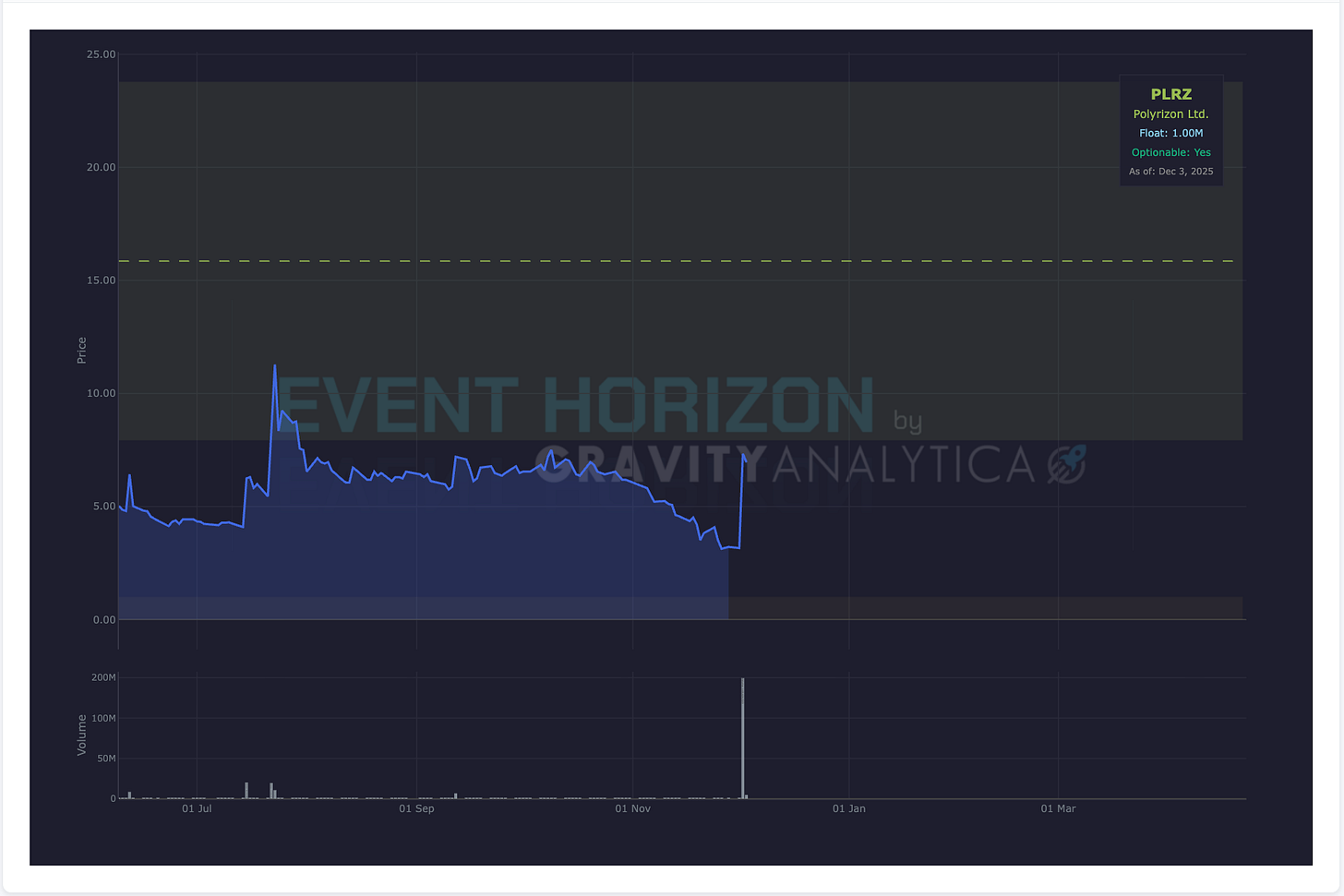

Polyrizon looks like the same post-RS, front-run play, but likely not a third-party. We do not own this but I know some of our subscribers did own this recently.

Well below the EM channel here before the move.

CAPR 0.00%↑ did file a prospectus on close today as discussed yesterday. Whoever owns the existing warrants must be pretty happy.

4,934,922 shares of common stock issuable upon the exercise of warrants outstanding as of September 30, 2025 with a weighted-average exercise price of approximately $5.70 per share;

12,813,485 shares of common stock issuable upon the exercise of options outstanding as of September 30, 2025 with a weighted-average exercise price of approximately $6.18 per share;

15,000 shares of common stock issuable upon the exercise of options granted subsequent to September 30, 2025 with a weighted-average exercise price of approximately $7.82 per shareCrypto:

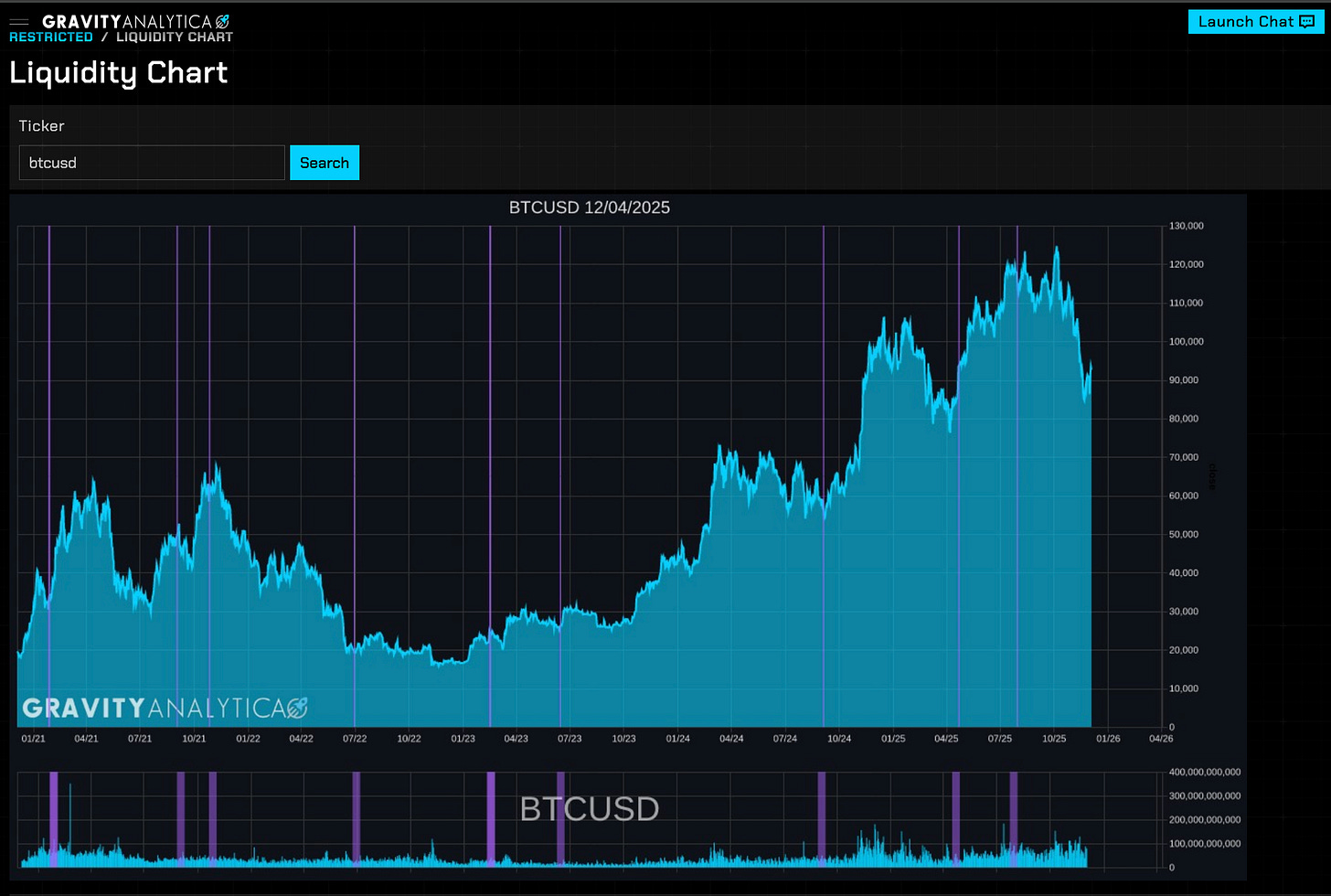

No ∆liquidity signature on bitcoin (or any token I looked at.) Assuming so far that this bounce is just short covering and there is no conviction.

Still monitoring.

If you like our risk/event charts they are available in chat via subscription. This subscription fee covers the cost of running all this code. Amazon Web services and data are not cheap.

As always, if you think there are spelling errors update your dictionary to the latest version. Happy speculation!

— AJ