What Happened Today?

Monday December 22, 2025

Macro:

Venezuela authorized two very, large crude carriers (VLCC) to set out to China.

This didn’t get a lot of reporting today but it seems directly provocative. Another opportunity for Trump to back down.

I think this action is why all precious metals jumped premarket in Asia trading.

Micro:

NYSE:$ABVX is all biotwitter cares about. I went through the details this morning. Still not a trade for us at this time. Too many unknowns.

I presume the timeline is, Eli Lilly contacted Abivax months ago and arranged a deal but it was determined before signing that the deal was unlikely to go through. So Abivax raised capital.

And Eli Lilly sought out an on-shore partner. And then even after securing this additional funding and splitting ownership, so that at least on paper Abivax stays partly French-owned, Eli Lilly is still uncertain the deal will go through. Which is why they met with officials before announcing anything.

Here is the report that sparked the retail short squeeze today and my translation. You should review the original yourself.

How would this information leak? And to whom does that leak serve? Well, it serves call option buyers and put writers. It also serves anyone wanting to sell and not wait out however long it takes.

Because of the winter holiday I am not sure how fast this deal could get done. Here is the latest guidelines from the French office.

And details on the previous review outcomes is here.

It’s 50/50 on the committee allowing similar acquisitions.

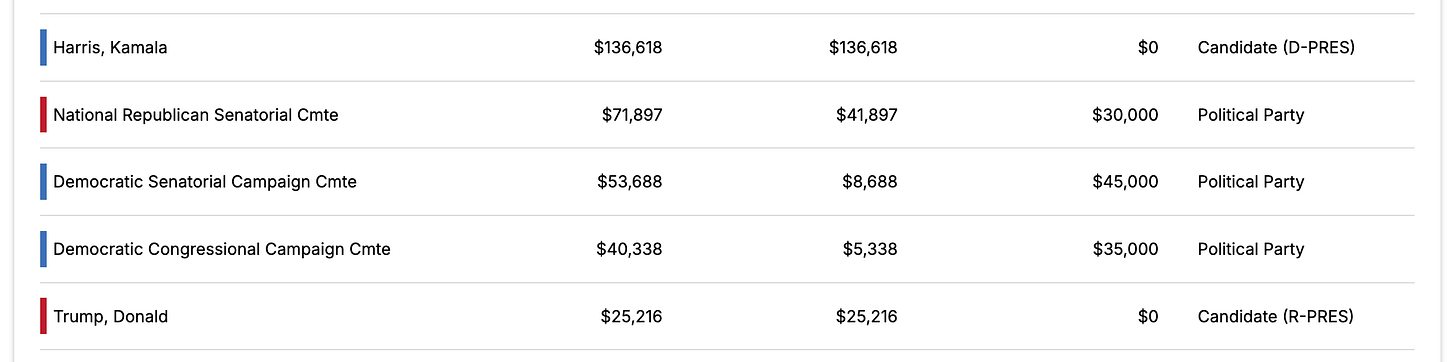

Plus France hates Trump and I don’t foresee Trump interceding when Eli Lilly made substantial contributions to Harris. If there was a rejection.

From my perspective every biotech we own is likely to go up more than 100% so unless I can narrow down the time frame or model an acquisition price the return on buying equity is not worth the risk. This is just a matter of opportunity cost and general reluctance to commit new capital to the market right now.

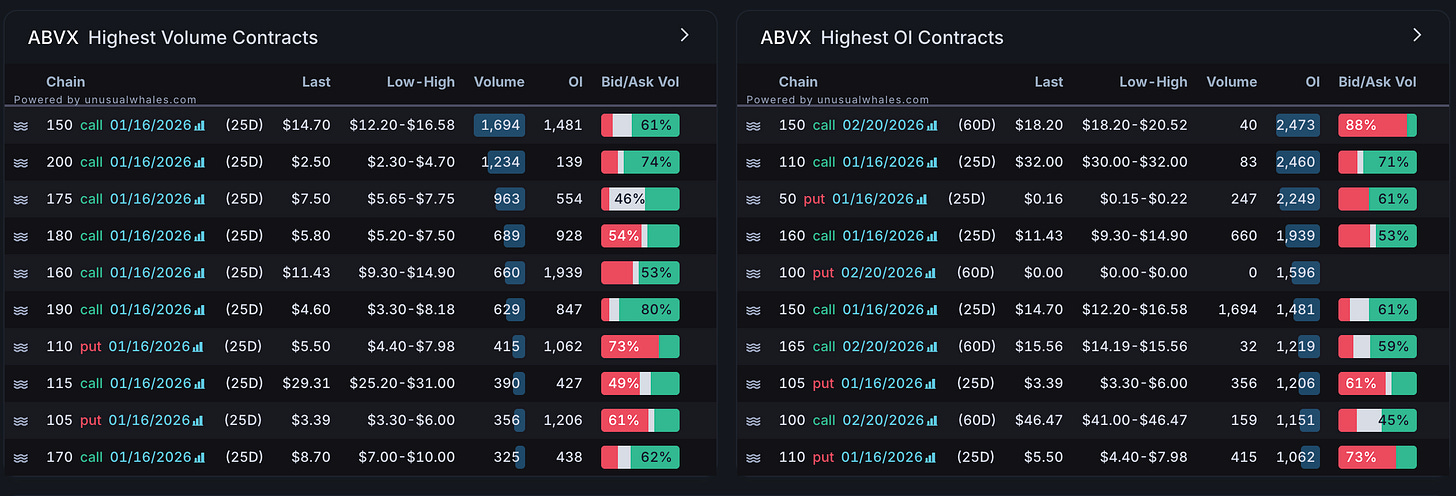

If I were to model this here is where I would start.

The Global IBD Market (UC + CD) is estimated to be $30B by 2030 and it will be late 2027/early 2028 before the drug could be approved unless Obefazimod gets priority review in which case mid 2027.

If there is no acquisition here that is a long time to tie up money.

If I could close one of those loops. Then I would buy calls. The return on an acquisition at $220 would be between 2 and 5x depending on strike. But, that return is what we expect for everything we already own. So this still wouldn’t be more than just another position.

It’s pretty obvious that someone is manipulating retail here as well. This has happened twice before. Once in 2020, a leak from a French paper made its rounds on Twitter for I think UMRX was the stock. And, last year a Twitter user was posting flight information on another buy out - one that didn’t happen. You can just search Twitter for the various jet tail numbers and see how often this happens.

NASDAQ:$ACRS was also added to the NBI today. We do own this. Made 250% last year and up 100% so far this round.

We invest in a lot of stuff. I am going to do a Substack on film production/financing and how the backend side of that works at some point soon if anyone is interested.

If you like our risk/event charts they are available in chat via subscription. This subscription fee covers the cost of running all this code. Amazon Web services and data plans are not cheap.

As always, if you think there are spelling errors update your dictionary to the latest version. Happy speculation!

— AJ