Zero to "Fuck You Money" (Repost from 10/2024

Happy Holidays!

Zero to Fuck You Money.

Most new market participants don’t think about what they want to accomplish. It’s been my observation that most people don’t actually believe they can make money in the market so they are dismissive about any serious attempt to do so.

So here is a plan to go from literally zero to “Fuck You Money.”

Let’s define “Fuck You” money as $400k/year which is $300k/year after taxes. This is enough money for most single people. Adjust the math to suit your life style expectations.

If you can get 8%/year on your portfolio (which is less than the average S&P 500 return of 10%,) you need $5M. Since on average, you will actually get higher returns you can build a buffer with any excess for any black swan market events allowing you to maintain this income if you stick to this.

This is a very safe plan. And, essentially what family offices try to do. Maintain incomes for the family members regardless of what the economy or stock market does. This is why hedge funds don’t have to beat the market. The goal is stability. Not returns.

Anyways, so that is the goal of this plan. $5M.

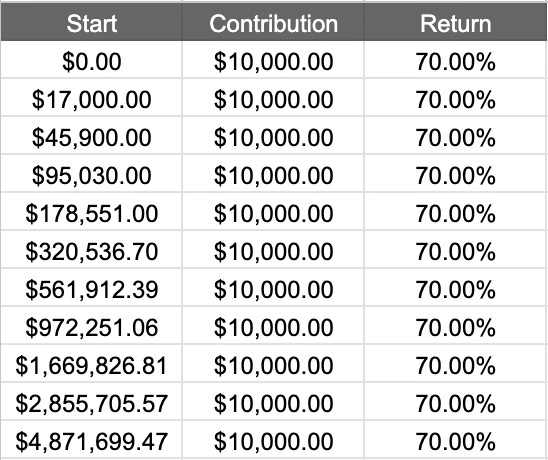

Assuming you can start with $10k and can add $10k to your account on January 1st of each year you can surpass $5M in 12.5 years if you average 70%/year return So “Fuck You Money” status achieved before you are 35 … ignoring taxes.

With paying taxes (which you should definitely do) it will take you two extra years… so 37. The key lesson here is you do not need nor should you try to get 10x trades.

This is the power of compounding and patience. Compounding you get for free from the math. Patience you have to learn.

The whole plan assumes you never get a raise. Never get laid off. Never take any money out of this account except to pay taxes unless you outperform your goals. But, what it doesn’t assume is the market won’t crash. Because it likely will at least correct if not crash. More on the in a minute.

You don’t need one stock to return 70%. You can find a few stocks that just combine to get that return, though in the beginning this might be a bit tricky. And is probably the biggest hurdle. When you start out as a market participant is when you have to be most accurate in what you are buying.

This is irony of the market. If you have a billion dollars you can be completely wrong and just move the market by leaning on it. If you have $10k you can be completely right and be forced to wait years before you get any profit. So is an unfortunate reality you just have to accept.

When you start out stock selection is very important but as your account grows you have more money so selection becomes less of an issue. You can take more of a throw a dart approach.

The odds of finding a trade that pays out greater than 3x is so slow you are just going to blow up your account before you get out of year two so don’t try to do this. In the beginning, it is best to wait out the best trade. This is the MOST IMPORTANT lesson a new trader needs to learn. If you want to get to “Fuck You Money” faster you need to start with more capital or you risk NEVER getting there.

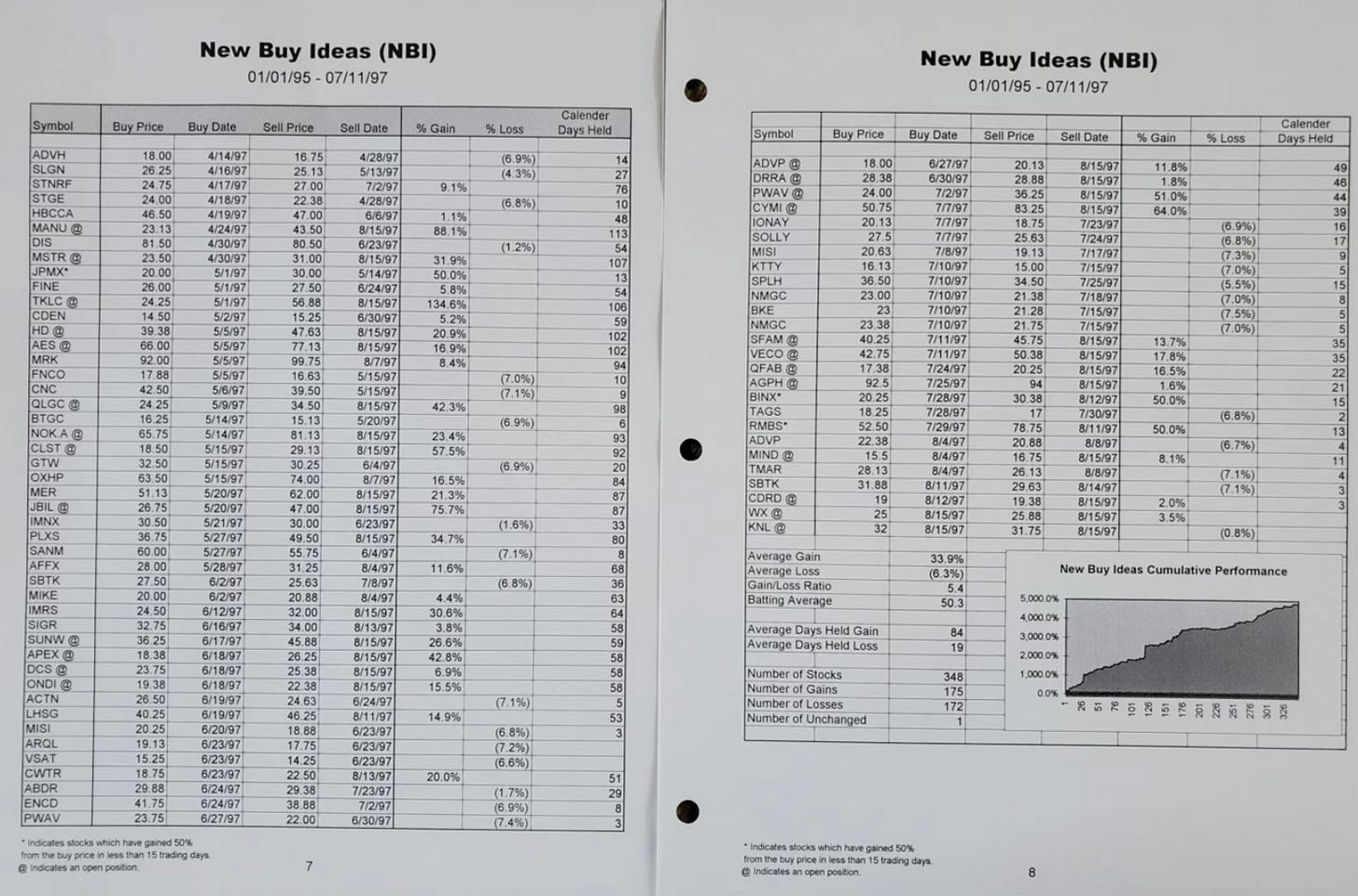

And, if you don’t believe you can reach 70%/year returns this will blow your mind. You can make 70+% a year with only a 50% win rate.

Here is the trade log of the US Investing Championship winning account from 1997 which returned 155%. The win rate was an abysmal 50.3%. (This is not my trade log. I didn’t start trading until 2000 and if you can’t get a win rate of 60+% you don’t understand the market at all… but even so he achieved a 155% return. Which is 100% above the market return.)

There are a lot of profitable strategies but making a mistake with a small account can cost you years of your life so be careful what strategy you follow. YOLO’ing options or following random social media account is probably a bad idea. In the beginning, protect your capital first. If you don’t know why you should buy a stock. Don’t buy that stock!

Just be very patient and wait.

Once you get to $100k you don’t have to be as patient as you can buy 10-20 different positions and as each move through your exit price, you can just rotate the generated cash into the others. The key is to know where the money is going to go and not chasing if a stock has moved before you can acquire a position. Making mistakes in a large account just falls into the accepted risk of the strategy and is to be expected.

Starting with $100k not only is skipping the line, so to speak, it also allows you to distribute risk more efficiently. Things get easier the more money you have up to a point. But, that point is between $50M-$100M so don’t worry about it right now.

Beyond $5M you either have to either start filing with the SEC or be careful to limit positioning under 4.9% of the float in each trade, which is a minor complication, but you really won’t need to adjust the trading plan until closer to $100M.

There are that many stocks out there. For any strategy, in any year, there are dozens to hundreds of good targets at any moment in time.

But, you don’t need to concern yourself since this “Fuck You Money” plan ends before you need to consider a strategy change as it ends at $5M.

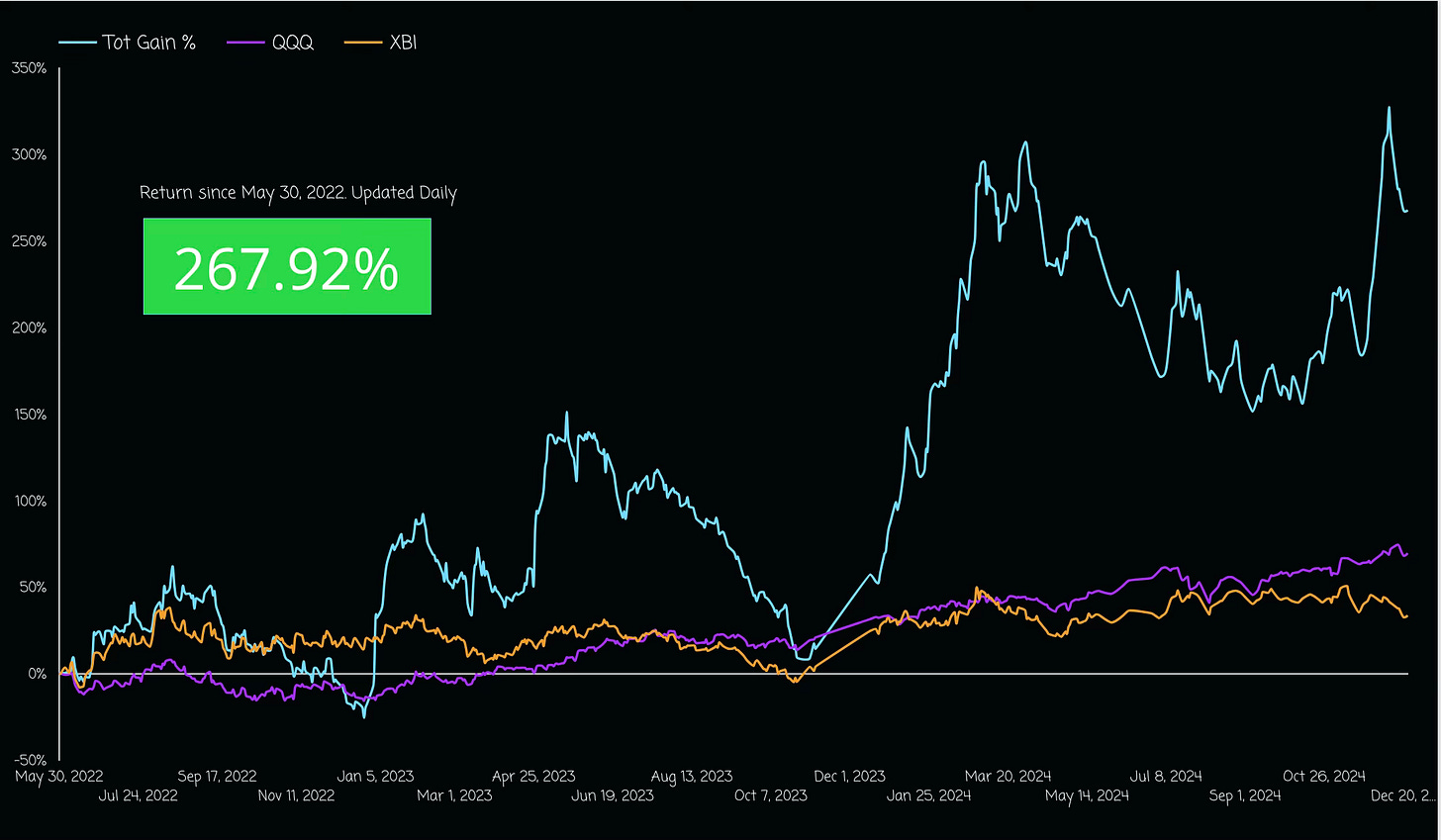

The chart below shows a live test account and has been fully invested during the entire Fed interest rate saga since May 2022. Running a risk asset strategy during rising interest rates and a panicky bond market is not ideal. This account has been biotech focused as well, which has been an underperforming sector during this period. And still as of today’s close, this is an average annualized rate of return of 71.98%.

And probably to your shock during this entire period I have never set a stop-loss. In fact, I have not set a stop-loss in 20 years of trading.

This chart shows something very important: macroeconomic factors cause volatility but a profitable strategy can survive volatility. This is something every famous investor will tell you.

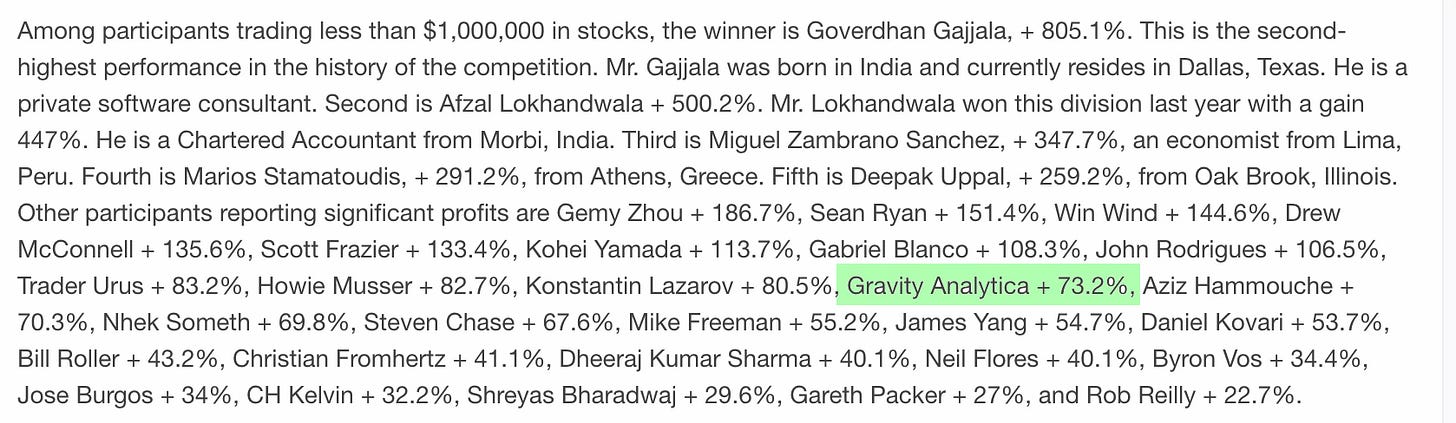

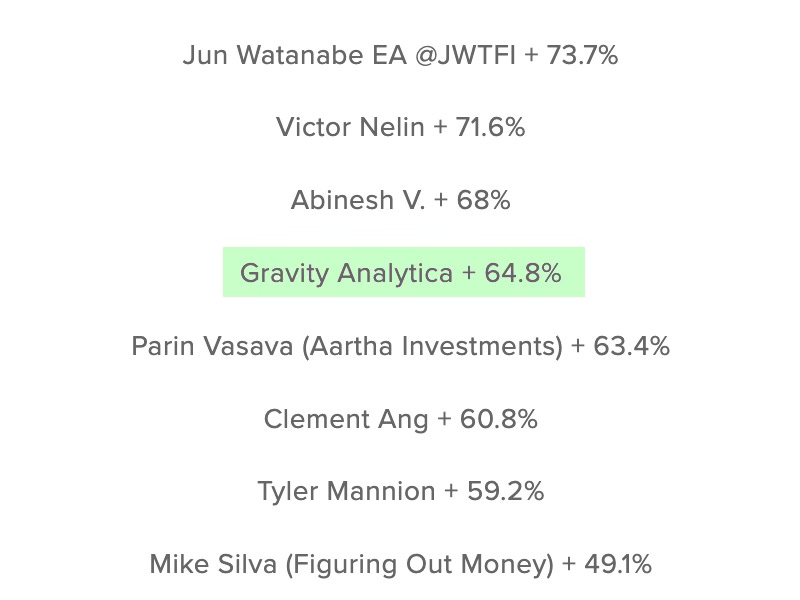

Now, since me posting a stock chart is meaningless and can be fabricated or photoshopped, I entered another account into the US Investing Championship in 2023 and continued with this same account unchanged in 2024 so there would be independently verification of brokerage statements.

To be clear, I am compounding 2023 gains here.

Here is the press release of the 2023 results.

And here is return as of October 2024 which is on target for another 70+% year.

In celebration of the Holiday’s we are offering a Free Week Trial. If you are interested to learn how I created the trading plan I am following for both accounts above consider joining us in Chat.

I hope you have a great holiday week and enjoy spending time with your family.

— AJ

We can be found on Twitter.

DISCLAIMER: DO NOT BASE ANY INVESTMENT DECISION UPON ANY MATERIALS FOUND ON THIS WEBSITE. We are not registered as a securities broker-dealer or an investment adviser either with the U.S. Securities and Exchange Commission (the “SEC”) or with any state securities regulatory authority. We are neither licensed nor qualified to provide investment advice. Our website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Past performance is not indicative of future results. The material contained on this page is intended for informational purposes only. GravityAnalytica.com is wholly-owned by Gravity Analytica, LLC. Our website is not an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content of our website and/or newsletter is not provided to any individual with a view toward their individual circumstances. While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained on our website is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between the any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment. We reserve the right to buy or sell shares of any company mentioned on our website or in our newsletter at any time. We encourage you to invest carefully and read investment information available at the websites of the SEC at

and FINRA at

The company or individuals affiliated may hold positions or may enter into, or exit, positions on any equities at any time. This website and materials found on this website, or in any communication, are meant for individuals of eighteen (18) years of age or older and are not suitable for younger audiences. Materials and information provided on this website and in any communications with or from Gravity Analytica LLC, it's employees or affiliates, are for personal education use by subscribers and may be not be used in any regard in competition with this website or any other product or service offered by Gravity Analytica LLC. Past results do not predict future returns. IF YOU DO NOT AGREE WITH THE TERMS OF THIS DISCLAIMER, PLEASE EXIT THIS SITE IMMEDIATELY. PLEASE BE ADVISED THAT YOUR CONTINUED USE OF THIS SITE OR THE INFORMATION PROVIDED HEREIN SHALL INDICATE YOUR CONSENT AND AGREEMENT TO THESE TERMS.