What Happened Today?

Wednesday December 17, 2025

Macro/Micro/Metals/Muh-Crypto:

Twitter-verse has discovered swaps!

For a basic overview of what a credit default swap is start here. And for a reminder just how tangled and exposed the market is to AI read this.

Since Burry, posted he is short (passively via puts) NASDAQ:$PLTR and NASDAQ:$NVDA the world has suddenly become anxious and hyper aware of scary acronyms again. There is always a rolling panic in the market. We moved from pandemic to inflation to war to tariffs to inflation to bubbles. Here is a fun historic piece on bubbles.

When you look at Twitter posts regarding “default probabilities” what you are seeing is a linear estimation of the 5 year probability of default. Not the probability of default in the next quarter. And, the linear estimation over estimates the expectation of default. If you want to follow along pseudo-real time bookmark this search. Twitter users are just going to keep on this every time a CDS moves. No need to pay $25k for a terminal. These people spend all day updating you.

The probability of CoreWeave missing a bond payment is 54% (as of last night when I did the math) over the next five years (which is typically the duration of bonds.) This is really more a reflection that banks/individuals loaned CoreWeave money at too low an interest rate because they failed to properly gauge the risk. Loaning a company that was just trying to mine bitcoin last week billions of dollars today is pretty dumb.

Doing so at 6.5% was fucking stupid. CoreWeave should have never gotten low rate to begin with.

Today, Blue Owl Capital just balked at giving OpenAI/Oracle another $10B dollars. This is definitely a harbinger of what is to come. Looking at you NASDAQ:$META and your SPEs.

Is this a big deal? Yes.

If you are the idiot that loaned these companies money it’s a huge deal.

Can they just convert the debt to equity? Also yes.

Is this a big deal? Maybe, if you are an idiot who bought stock in one of these companies.

Selling shares is what the public sector is for and that is what they will do. CoreWeave will just create shares out of thin air and dump them. Onto the market if they have to. After the CEO sells of course. We are not heathens as they say.

Can you see this play out? Yes. Just follow the repo market and CDS pricing. When banks get nervous and stop loaning other banks money you should pay attention.

But, are people really concerned enough to do something proactive i.e. are they selling? Or just Tweeting about this giant hairball the market is going to eventually cough up so they can appear smart?

Well, are you selling? This is a poll of sample size one: you. Has any of this caused you to dump your account? If you own tech stocks have you at least dumped them?

I sold off all of our tech holdings and QQQ in December of 2024 (which had been our largest position by far for all of 2024. It was larger than all other positions combined.) so we have no skin in the AI game. At all. Except in PC.

The reality is in crashes few people actually sell. Most just lose money. FOMO is too powerful and this bull market has been going on far too long.

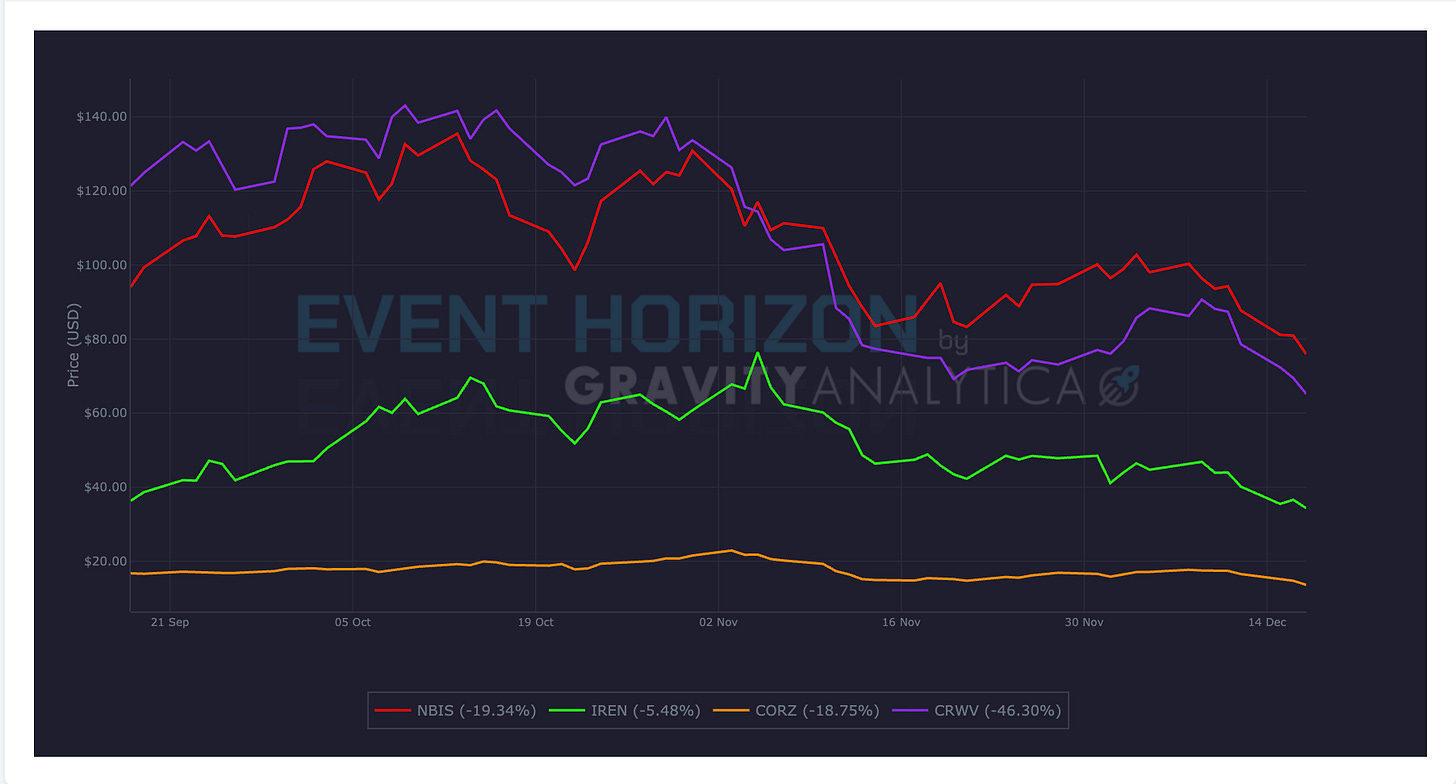

Above are the charts of the big 4 data center plays. These stocks are already down 50% from their highs in October (pre Burry, P.B.)

So the growth expectations of these companies has already began to dissipate. You could say the bubble is already bursting. It’s right there to witness. If you go back and look at 2008 and 2000 the market actually started selling off months before it dumped. And “crashes” are very slow moving. They take years to unfold.

There is a difference between buying insurance and a full on running for the exits. And I am not sure people who buy insurance ever exit so be careful who you listen to. That fund manager online who isn’t selling a share might be fully hedged.

Right now it is just every little piece of news drops bid pressure. People are not buying dips as frequently but they aren’t selling yet. How long this goes on for and how many rallies there are along the way I certainly don’t know.

I’ve been planning on exiting any stocks that might ride volatility since August but with the exception of puts on Oracle I am not short the market. Yet. So I am not selling this market either. I am carrying more cash today (and since August) than I have since April.

But here is reality all the doom and gloom narratives are correct.

Quoted depreciation schedules are bullshit. The accounting does not make sense and it is very CISCO, ENRON, like.

OpenAI isn’t going to make enough money to pay off its commitments. It’s probably thermodynamically impossible.

But, share repurchases are still on and until revenues fall I think the market will just stall for awhile. And I expect a lot of volatility around the “news” cycle.

It’s a good time to swing trade or run an umbrella strategy on stocks you really like but that might jump around a bit. Which is what I’ve been doing.

What interests me - and that isn’t getting much attention - is that Bluerock Private Real Estate Fund, or NYSE:BPRE went public yesterday and opened at -40% of net asset value (NAV.) This is like you buying a house for $1M and then listing it and finding no one will bid more than $600k.

Ouch.

It’s even worse because in 2023 Bluerock estimated the value of your house to be $1.5M. That is quite a haircut. This is a real big problem. You see all private equity has the same issue. The value of the assets is nowhere near the value the PE firms have been reporting. Going public was a last ditch effort to try and get un-inverted.

This is going to get R-rated because I find PE offensive to common sanity and civility.

Buffett has this great line that when the tide goes out you get to see who is swimming with no pants. Well, private equity has been swimming without pants and upside down just under the surface, out-of-view of other bathers, for a long time.

We are just now getting to see their feet flaying at the surface. Soon. Thighs.

Then… wieners.

And still they will be upside down. Drowning.

Is the public sector going to right them knowing when the tide goes out they are still swimming with no pants? That is what they hope will happen (same for Space-X, OpenAI, the IPO escalator to nowhere liquidity exit) but what the Blue Rock IPO shows is retail might not be as dumb as so called “smart money” thinks.

For me the real concern is what happens when investors begin to see all of their holdings fall from mark to market? What are they going to dump first?

I think bitcoin will be the first to go. Logically you dump vaporware first. And we have already seen the ETFs unload.

A bit iffy after crypto.

Where will the blood be. Equities? Real Estate? Rare books? Small Caribbean Islands???

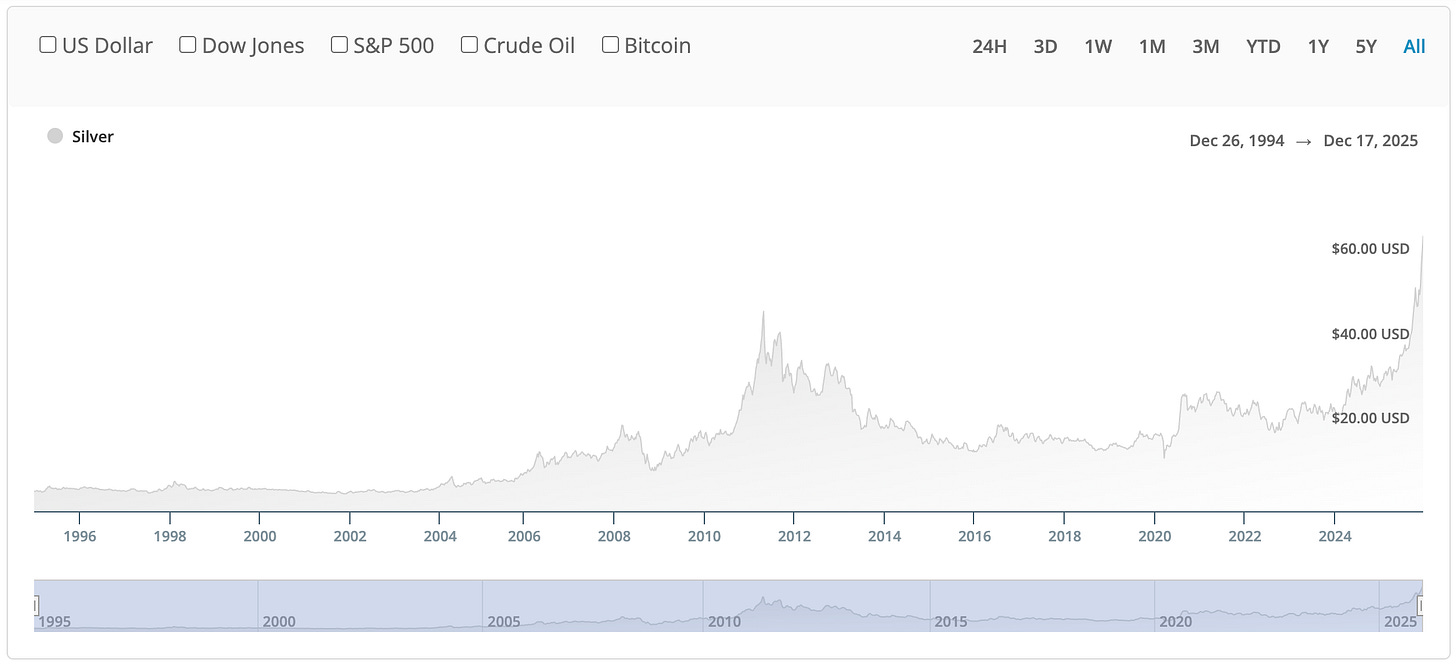

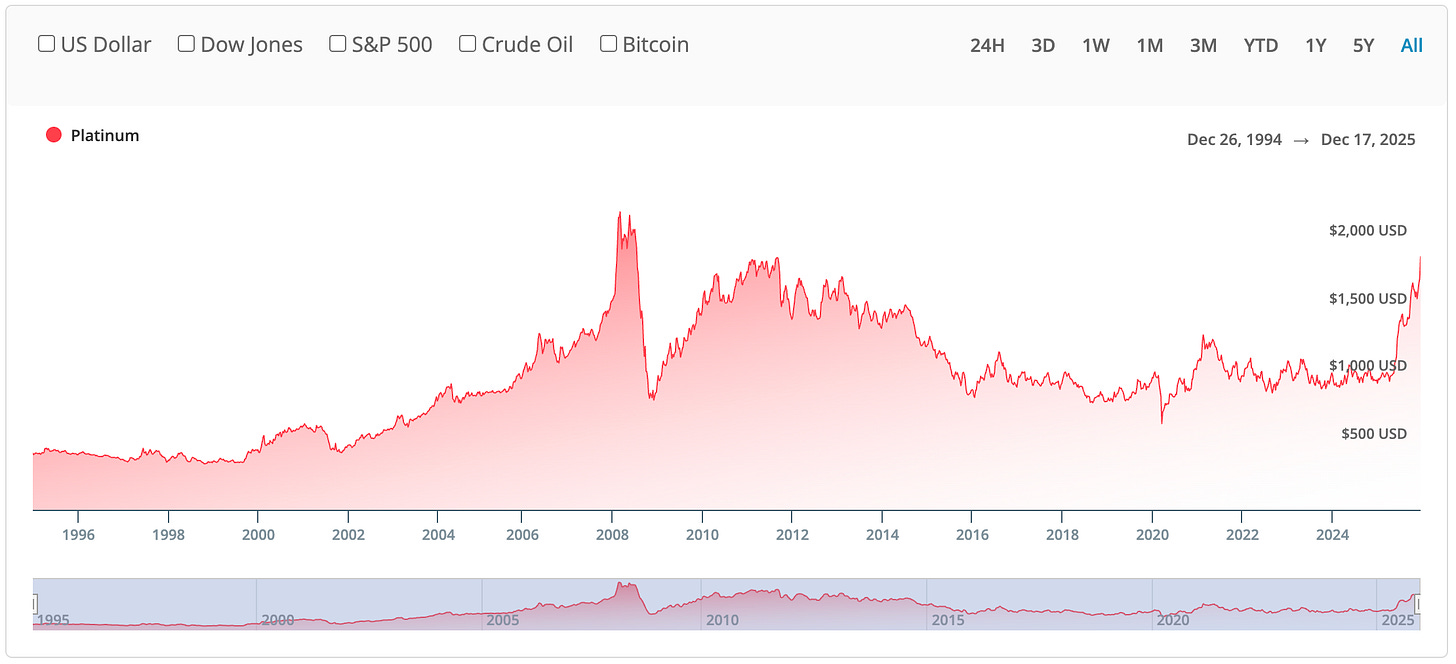

Here are the historical charts of silver and platinum. It would be rather ironic if these two metals switched rolls this time around.

I think that is exactly what has happened.

Back then in the days when we had trading commissions, the way, way back in 2008, the “stackers” could afford to stack platinum and only after the stock market crash did people run into silver (the cheapest “precious” metal.)

This time stackers can’t afford platinum (or gold really as it has been running for years) up front and post-exit crypto traders have (or at least) trying to corner silver.

Don’t focus on today. Look at what happened from 2006-2009.

Also, and seemingly as a footnote here, CPI data comes out tomorrow morning. The Blue Owl news already crushed bid pressure unfortunately. So the easy options play is gone. With the exception of flipping some equity positions and one small IWM Call trade I didn’t do much today.

If CPI prints 0.00% the rate cut narrative will once again swing. If it prints 0.5%, loose shit will hit fan blades.

If you like our risk/event charts they are available in chat via subscription. This subscription fee covers the cost of running all this code. Amazon Web services and data plans are not cheap.

As always, if you think there are spelling errors update your dictionary to the latest version. Happy speculation!

— AJ